Start Your Custom Quote Process™

Medical Malpractice Insurance for Virginia Physicians

Compare Quotes from Every Major Medical Malpractice Carrier in Virginia

Our partners

Table of Contents

- Medical Liability Claims Trends for Virginia Healthcare Providers

- Malpractice Insurance Requirements for Virginia Physicians

- Why Malpractice Insurance Still Matters in Virginia

- What Factors Impact Malpractice Insurance Rates in Virginia?

- Client Testimonials

- How to Get the Best Malpractice Coverage in Virginia

- Historic medical malpractice insurance rates in Virginia – since 2000.

- Frequently Asked Questions: Virginia Medical Malpractice Insurance

- Resources for Physicians.

What Virginia Medical Professionals Should Know About Malpractice Coverage

Virginia maintains a regulated and relatively stable malpractice environment, but there are distinct legal rules every physician should know. From caps on damages to annual adjustments for those caps, the timing of an injury matters. Hospitals and health systems typically require proof of coverage for credentialing. With evolving case law and rising healthcare costs, making sure your malpractice policy is well‑matched to both your specialty and Virginia’s legal framework is critical.

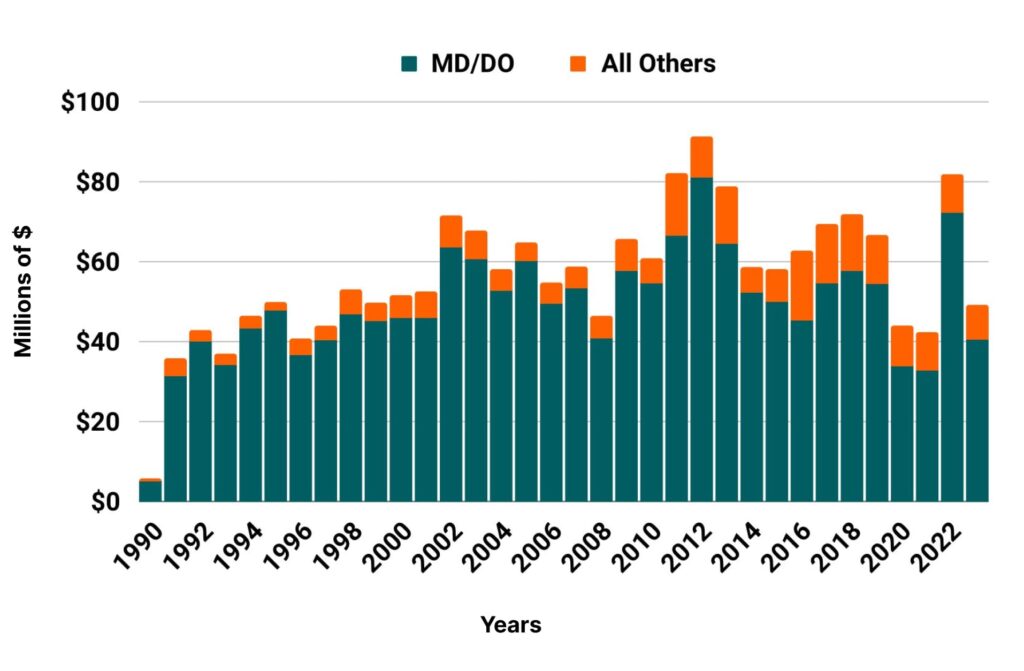

Medical Liability Claims Trends for Virginia Healthcare Providers

Virginia NPDB from 1990 to 2023

Malpractice Insurance Requirements for Virginia Physicians

Virginia does not require physicians by state law to carry medical malpractice insurance. However, most hospitals, clinics, and health systems expect active coverage for credentialing, employment, and admitting privileges. While there’s no mandated policy limit by law, many physicians carry limits that align with Virginia’s statutory caps to avoid personal liability risk.

Why Malpractice Insurance Still Matters in Virginia

Even though Virginia has long had damage caps and procedural protections, potential exposure remains. As of July 1, 2024, the cap on total damages (economic + non‑economic) for injuries occurring during that period increased to $2.65 million, and it will continue rising by $50,000 per year until it reaches $3 million on July 1, 2031.

What that means: even if a jury awards more, Virginia law limits what can actually be collected. For physicians, this creates more predictable worst‑case scenarios, but it also means policy limits need to match the highest possible cap. Costs of defense, long jury trials, and reputational risk still matter even if the cap prevents an unlimited payout. Also, **punitive damages are capped separately (e.g. $350,000) under certain conditions.

** Citations:

What Factors Impact Malpractice Insurance Rates in Virginia?

Several variables drive how much malpractice coverage will cost:

- Specialty: Procedural specialties or those with high risk (surgery, OB/GYN, anesthesiology) tend to see higher rates.

- Policy type: Whether your policy is claims‑made vs occurrence. Claims‑made policies are usually cheaper up front but may require tail coverage when you switch or retire. Occurrence policies often cost more but simplify some risks.

- Claims history: Any prior claims or adverse events can raise premiums.

- Coverage limits: If your limit is near or above what the statutory cap allows, carriers may charge more given potential exposure.

- Timing of injury: The date when the injury occurred (not just when a case is filed or a verdict is rendered) matters under Virginia law because caps are tied to the date of the act.

- Workload, setting, geography: Volume of procedures, hospital vs private practice, and even region can play a role in underwriting risk.

| Specialty | Average Annual Premium Range* | Risk Level | Why Rates Are Higher |

| Obstetrics and Gynecology | $28,000 – $96,000 | High | Surgical complexity, high litigation frequency, potential for severe damages to mother and infant. |

| General Surgery | $20,000 – $89,000 | High | Invasive procedures, high potential for complications, critical patient outcomes. |

| Orthopedic Surgery (No Spine) | $18,000 – $54,000 | High | Surgical procedures, high potential for complications and dissatisfactory outcomes. |

| Emergency Medicine | $47,000 (Base Rate) | Medium-High | High-volume, fast-paced environment, critical diagnoses under time pressure. |

| Radiology – Diagnostic | $9,000 – $41,000 | Medium | Diagnostic errors, failure to identify critical findings, potential for delayed care. |

| Anesthesiology | $33,000 (Base Rate) | Medium | Procedural specialty, risk of patient injury during anesthesia administration. |

| Internal Medicine | $6,900 – $17,000 | Low | Primarily diagnostic and therapeutic risk, prescription errors, limited invasive procedures. |

| Psychiatry | $11,000 (Base Rate) | Low | Minimal invasive procedures, risks related to patient care and prescription management. |

| Ophthalmology (No Surgery) | $4,400 – $8,000 | Very Low | Limited invasive procedures, risks related to diagnosis and prescription. |

*Note: Individual rates can vary based on things like claims history, location, and other factors.

Virginia

- Internal Medicine Average Rate $6,934

- General Surgeon Average Rate $20,802

- OB/gyn – Average Rate $28,411

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Physician in VirginiaTim provided superior service – timely, clear and direct advice. After a thorough research he presented several options to choose from different plans. The policies were well suited to my needs and he explained them all the complex details in simple and practical terms. Thanks and Keep up the great work!

Neurologist in VirginiaI wish to take this opportunity to let you know how impressed I am with your professionalism, dedication, effectiveness, and consequentiality. I would be honored to recommend you and your services to others.

How to Get the Best Malpractice Coverage in Virginia

Here are practical steps Virginia physicians can take to optimize coverage:

- Shop across many carriers, both statewide and regional ones, don’t settle with the first quote.

- Align policy limits with the statutory cap so you’re protected in worst‑case scenarios.

- Think ahead about tail coverage if you’re on a claims‑made policy and might change jobs, retire, or move.

- Document risk mitigation (good medical records, peer reviews, safety protocols), these can help lower premiums or improve underwriting terms.

- Review policies annually, as caps rise and legal precedents shift, what was adequate one year might not be the next

Historic Medical Malpractice Insurance Rates in Virginia for Physicians.

Frequently Asked Questions: Virginia Medical Malpractice Insurance

Q: Is malpractice insurance required by Virginia law?

No. But most healthcare employers, hospital systems, and credentialing bodies expect it. Lack of coverage can limit your ability to practice.

Q: What is the damage cap for malpractice cases in Virginia?

The cap on total compensable damages (economic + non‑economic) for malpractice after July 1, 2024 is $2.65 million, rising by $50,000 each year until July 1, 2031 when it will reach $3 million.

Q: Does the cap apply to punitive damages?

Yes, there is a separate cap on punitive damages (around $350,000) under certain conditions. However, because the total cap applies to all damages (economic + non‑economic + punitive), punitive damages are constrained by the overall cap.

Q: Do I need tail coverage in Virginia?

Yes, if you are under a claims‑made policy and you plan to change insurers, retire, or end the policy. If you stay under the same insurer or have an occurrence policy, the need can be different.

Q: How can I lower my malpractice insurance premium without risking coverage?

Work with a broker who understands the Virginia market, align your limits appropriately, ensure documentation and risk management are strong, and compare quotes across carriers.

Get a Quote from All Major Virginia Carriers

We work with:

- The Doctors Company

- ProAssurance Indemnity Co.

- Medical Protective

- Coverys

- Professionals Advocate Ins. Co.

- MAG Mutual

- NORCAL

One form. Every top carrier. Your best rate, without the hassle.Start your quote now »

Resources for Virginia Physicians

Medical Society of Virginia

Virginia Bureau of Insurance

Virginia Hospital and Healthcare Association

Virginia Board of Medicine

Virginia Osteopathic Medical Association

Virginia Medical Group Management Association

Virginia Department of Medical Assistance Services

Medical Malpractice Insurance Guide