Start Your Custom Quote Process™

Malpractice Insurance for Doctors & Physicians in Utah

Let our specialists compare medical malpractice insurance quotes for your practice in Utah

Our partners

Table of Contents

- Medical Liability Claims Trends for Utah Healthcare Providers

- How to buy medical malpractice insurance in Utah.

- How to save money on your malpractice insurance.

- How much does medical malpractice insurance cost in Utah?

- Medical malpractice requirements in Utah.

- Find Coverage for your Practice

- Client Testimonials

- Best medical malpractice insurance companies in Utah.

- Why partner with Cunningham Group in Utah?

- Historic medical malpractice insurance rates in Utah – since 2000.

- History of malpractice insurance in Utah.

- Resources for Physicians.

Utah Malpractice Insurance

Malpractice insurance rates in Utah are high, even though the state has passed many tort reforms over the years. Utah’s first medical malpractice reforms were the Utah Health Care Malpractice Act of 1976, which was passed in response to the medical malpractice insurance crisis of the 1970s. Since then, Utah has amended and refined the Act several times.

Our 2023 Physician Buyers Guide for purchasing malpractice insurance in Utah gives you the information necessary to obtain the strongest, most financially secure policy at the best price. When shopping for coverage, you need a full view of the Utah marketplace to find the company that best fits your situation. Choose a broker that can offer multiple quotes from all the major malpractice insurance companies in Utah.

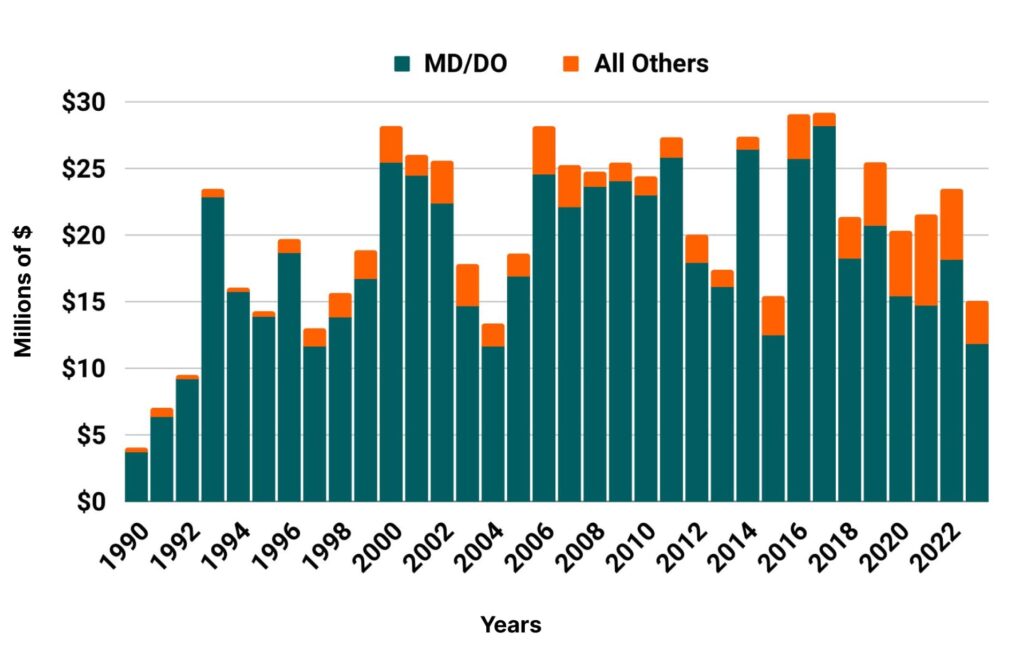

Medical Liability Claims Trends for Utah Healthcare Providers

Utah NPDB from 1990 to 2023

How to buy malpractice insurance in Utah.

The best way to buy malpractice coverage is to work with a reputable malpractice insurance broker in Utah who can generate multiple quotes. Your broker will walk you through the lengthy insurance application and underwriting process. Click to get medical malpractice insurance quotes from every major Utah malpractice insurance company.

Typically, the malpractice insurance purchasing process goes like this:

- Submit your information for your free medical malpractice insurance quote from every major insurance company in Utah.

- One of our veteran malpractice insurance agents who specializes in the Utah market will contact you to learn more about your specific needs.

- We shop your coverage to every major insurance company in Utah.

- We present you with a number of insurance quotes and give you the information necessary to make an educated and informed decision. Don’t worry. We’re here every step of the way, helping you get the best price with the best company.

At renewal time, we restart the process of shopping your coverage among every major carrier to keep your policy properly priced.

How to save money on your malpractice insurance.

- The easiest way to save money on your medical malpractice insurance policy is by working with a broker who has the access to generate quotes from every major insurance company, offering an accurate view of the marketplace. As one of the top brokers in Utah, we can guide you through the application and underwriting process so you’re confident you secured the best price with the right insurer for your situation.

- The most common limits in Utah are $1 million/$3 million. Limits of liability play a major role in determining the overall cost of your policy. Some companies will offer lower limits to save you money. We don’t recommend this. We want your risks fully indemnified so you never have to pay an award out of pocket. Let us save you money by shopping your coverage rather than skimp on protection.

- Check out our 7 secrets your medical malpractice insurance agent won’t tell you page to get insider information on buying coverage in Utah.

How much does medical malpractice insurance cost in Utah?

Rates for physician malpractice insurance don’t vary much depending on where you practice within the state. Most major insurance companies classify Utah as a single territory, which means your specialty’s base rate does not vary depending on your practice address. But you still want multiple quotes to get an accurate view of the marketplace. This is one of the many reasons it’s important to work with an insurance agency that specializes in medical malpractice insurance. Below are mature, base rates with no credits or discounts. We typically get our clients a 30-50% reduction from these rates:

Utah

- Internal Medicine Average Rate $6,371

- General Surgeon Average Rate $33,114

- OB/gyn – Average Rate $46,674

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Medical malpractice requirements in Utah.

Limits of Liability: The most common limits of liability in Utah are $1 million per claim with an annual aggregate cap of $3 million.

Most hospitals require a physician carry malpractice insurance prior to granting admitting privileges. Some of the hospital systems requiring this include, but are not limited to, Intermountain Medical Center in Murray, University of Utah Hospital in Salt Lake City and McKay-Dee Hospital in Ogden.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

OB in UtahCunningham made the process of obtaining an appropriate and much less expensive tail policy easy. I have been impressed with how promptly my questions were addressed and the overall great customer service. I have been impressed with how promptly my questions were addressed and the overall great customer service.

Best Medical malpractice insurance companies in Utah.

- Medical Protective

- The Doctors Company

- NORCAL

- UMIA Insurance Inc.

- Lexington Insurance Co.

- Mutual Insurance Co. of Arizona (they write physician malpractice coverage in multiple states)

Why partner with Cunningham Group?

Partnering with Cunningham Group will give you a full view of the Utah marketplace.. Our veteran insurance agents average 10+ years of industry experience. Let us help you secure medical malpractice insurance quotes from every major insurance company in Utah.

Historic Medical Malpractice Insurance Rates in Utah for Physicians.

History of Medical Malpractice Insurance and Tort Reform in Utah.

Utah’s initial reforms in 1976 helped to establish a framework to define and govern the handling of medical malpractice acts, including establishing standard of care and requirements for expert testimony. Important amendments to the act included the 1986-establishment of a $250,000 noneconomic damages cap, abolishment of joint and several liability and requirement for a pre-litigation panel hearing to screen all claims and determine merit. A 1999 amendment created an arbitration system for the state, and, from 1999 to 2003, arbitration agreements between physician and patient were becoming increasingly common within the Utah healthcare community. In 2003, the physician lobby pushed for legislation that would allow physicians to terminate their relationship with patients who would not sign away their right to a jury trial. After considerable public backlash against the proposed law, and a state supreme court case in which the court refused to enforce an arbitration agreement, the idea of mandating arbitration prior to the performance of a healthcare service was abandoned.

In 2001, the state’s noneconomic damage cap was increased to $400,000. The cap withstood a constitutional challenge in 2004, with the Utah Supreme Court finding that the damages cap did not violate the state’s separation of powers doctrine, writing “The legislature imposed this cap because it was convinced that doing so would limit malpractice insurance costs for medical professionals, thereby helping to control excessively high medical care costs and health insurance premiums paid by most citizens and assuring a continued supply of medical care to all. This was a policy choice made by the legislature, as is its duty… The damage cap represents law to be applied, not an improper usurpation of jury prerogatives. Consequently, it does not violate the separation of powers provision of the constitution.”

Further amendments were made to the act in 2010, when a ‘hard cap’ of noneconomic damages was set at $450,000 (no adjustments for inflation) and a requirement for an affidavit of merit in medical malpractice cases was instituted. Under the new amendments, in a malpractice action against a healthcare provider, the injured plaintiff may recover noneconomic losses to compensate for pain and suffering, but the total loss cannot exceed $450,000. This new hard cap removed any adjustment of the cap due to inflation. The previous cap—which included provisions for inflation adjustment—had grown since its 2001 inception from $400,000 to $480,000. Tort reform advocates argued that the hard cap would provide greater predictability, which would allow medical professional liability insurers to keep policy premiums in check.

The affidavit of merit portion of the 2010 amendments updated the pre-litigation panel process instituted in 1985. The most significant change is a requirement that a plaintiff obtain an “affidavit of merit” prior to a lawsuit being filed. This requirement applies if the pre-litigation hearing panel finds that the claim lacks merit, either for lack of breach of the standard of care or for lack of resulting damage. The affidavit of merit must consists of two affidavits: (1) the attorney must execute an affidavit stating that the attorney or claimant has consulted with and reviewed the facts of the case with a healthcare provider who has determined after review of the medical records and other relevant information “that there is a reasonable and meritorious cause for the filing of a medical liability action”; (2) the affidavit of merit must also include an affidavit signed by a healthcare provider appropriately licensed in the same specialty as the defendant. Essentially, the affidavit of merit functions as a second opinion to the pre-litigation panel’s conclusions. If the panel finds merit, the affidavit of merit is not required; however, if the panel finds the claim non-meritorious, then the claimant must produce sworn expert opinion testimony supporting the claim before filing suit. Ultimately, the Utah Supreme Court struck down the 2010 portion of the law that outlined the process of a healthcare provider offering an affidavit that is then sent to DOPL. The original DOPL pre-litigation hearing process remains intact.

In 2019, the Utah Supreme Court declared a portion of the state’s pre-litigation medical malpractice review panel process under the Utah Health Care Malpractice Act unconstitutional because it violates the separation of powers doctrine. The reasoning behind the decision rests on two distinct constitutional provisions: the separation of powers ensconced in Article V of the Utah Constitution and the judicial power vested in Article VII. Under both articles, the DOPL was determined to be infringing on the purview of the judiciary.

“While Article V regulates and guides the apportionment of authority and function between the branches of government, the core judicial power vested in the courts by Article VIII is always retained by the judiciary — regardless of whether the party attempting to exercise a core judicial function belongs to another that the “explicit vesting of jurisdiction in the various courts of the state is an implicit prohibition against any attempt to vest such jurisdiction elsewhere,” the Justices wrote. “Additionally, the ‘[c]ore functions or powers of the various branches of government are clearly nondelegable under the Utah Constitution.’ Notably, the core judicial function of courts includes ‘the power to hear and determine controversies between adverse parties and questions in litigation.’”