Start Your Custom Quote Process™

Medical Malpractice Insurance for Tennessee Physicians

Compare Quotes from Every Major Medical Malpractice Carrier in Tennessee

Our partners

Table of Contents

- Medical Liability Claims Trends for Tennessee Healthcare Providers

- Malpractice Insurance Requirements for Tennessee Physicians

- Why Malpractice Insurance Still Matters in Tennessee

- What Factors Impact Malpractice Insurance Rates in Tennessee?

- Find Coverage for your Practice

- Client Testimonials

- How to Get the Best Malpractice Coverage in Tennessee

- Historic medical malpractice insurance rates in Tennessee – since 2000.

- Frequently Asked Questions: Tennessee Medical Malpractice Insurance

- Resources for Physicians.

What Tennessee Medical Professionals Should Know About Malpractice Coverage

Tennessee’s medical liability landscape has evolved substantially in recent years. With procedural reforms, statutory caps, and well‑defined filing requirements, the state offers somewhat more stability than in earlier decades. Still, malpractice exposure remains real, especially for physicians in specialties with higher patient contact, surgeries, or risky procedures. Having a policy that aligns with both your practice type and Tennessee’s legal environment is essential for protecting your reputation, credentialing status, and financial well‑being.

Medical Liability Claims Trends for Tennessee Healthcare Providers

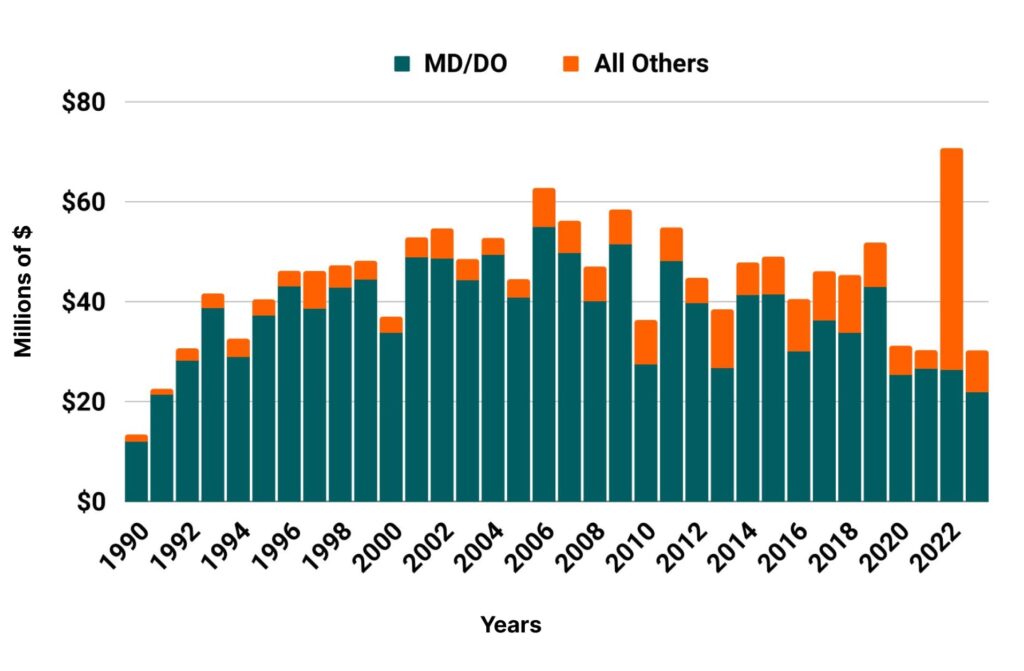

Tennessee NPDB from 1990 to 2023

Malpractice Insurance Requirements for Tennessee Physicians

Tennessee doesn’t mandate that physicians carry malpractice insurance by law. However, most hospitals, health systems, and credentialing bodies require active coverage. If you’re seeking admitting privileges or joining insurance networks, you will almost certainly need proof of malpractice insurance. Most commonly, physicians in Tennessee carry policies with limits around $1 million per claim / $3 million annual aggregate. These limits are accepted widely across hospitals and insurers in the state. (If your specialty or practice setting is higher risk, you may find that institutions look for stronger coverage levels.)

Why Malpractice Insurance Still Matters in Tennessee

Even with Tennessee’s legal reforms, significant financial risks persist. In 2011, the state passed the Tennessee Civil Justice Act, which capped noneconomic damages at $750,000 per injured plaintiff, rising to $1,000,000 for catastrophic injuries (such as paralysis, major amputations, or wrongful death of a parent with dependent minor children).

In many cases, these caps don’t apply, for instance when there’s intentional harm, intoxication, fraud, or other egregious misconduct. Plus, other features such as punitive damages (capped under Tennessee law) and pre-filing notice requirements add legal complexity that can catch physicians off guard if they’re not prepared.

So, malpractice insurance provides more than financial protection, it’s a safeguard for your career. Whether defending a claim, maintaining hospital privileges, or ensuring you’re covered through changes in your practice, you want a policy that reflects Tennessee’s realities.

What Factors Impact Malpractice Insurance Rates in Tennessee?

Here are the key variables that tend to drive rates in Tennessee:

- Specialty: Riskier specialties (e.g. surgery, OB/GYN, anesthesiology) often face substantially higher premiums.

- Claims History: Previous claims (and outcomes) can seriously affect your renewal costs.

- Coverage Limits: Higher limits = more protection, but also higher cost. Choosing limits appropriate to your risk profile is critical.

- Policy Type: Whether the policy is claims-made or occurrence, claims‑made require tail coverage when switching or retiring, occurrences do not.

- Legal Caps & Exceptions: The noneconomic damages cap ($750,000 standard / $1,000,000 catastrophic) is an important constraint, but physicians need to be aware of the exceptions and how they might apply.

- Workload and Environment: Procedural volume, practice complexity, whether you are hospital-employed or independent, and geography (while less extreme compared to some states) can impact exposure and underwriting.

| Specialty | Average Annual Premium Range* | Risk Level | Why Rates Are Higher |

| Obstetrics and Gynecology | $33,530 – $71,000 | High | Birth injuries, extensive patient contact, surgical procedures, and a high potential for catastrophic outcomes |

| General Surgery | $25,925 – $48,000 | High | Invasive procedures, high rate of claims, and the potential for severe, long-term patient harm |

| Orthopedic Surgery | $44,000+ | High | Complex surgical procedures, risk of surgical errors and lasting patient disability |

| Emergency Medicine | $32,000 | Moderate | High-volume, time-sensitive care, and the need for rapid diagnosis and stabilization of a diverse patient population |

| Anesthesiology | $21,000 | Moderate | Management of patient life support during procedures and the potential for severe complications related to drug administration |

| Radiology – Diagnostic | $23,000 | Moderate | Misdiagnosis or delayed diagnosis of serious conditions like cancer or stroke |

| Internal Medicine (No Surgery) | $6,186 – $11,000 | Low | Non-invasive, non-surgical practice; risk primarily related to misdiagnosis or medication errors |

| Family Practice (No Surgery) | $11,000 | Low | Similar to Internal Medicine, with a focus on general, preventive care; low risk of severe physical injury claims |

| Psychiatry | $8,000 | Low | Non-invasive practice with risk stemming from prescribing errors, patient self-harm, or other behavioral-related issues |

| Dermatology (No Surgery) | $8,000 | Low | Non-invasive specialty with minimal risk of catastrophic physical injury to patients |

*Note: Individual rates can vary based on things like claims history, location, and other factors.

Tennessee

- Internal Medicine Average Rate $6,186

- General Surgeon Average Rate $25,925

- OB/gyn – Average Rate $33,530

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Medical Director in TennesseeI was looking for Medical Director Malpractice insurance and a colleague recommended Trent from Cunningham Group. The service I received was efficient, direct and professional. I would definitely recommend them.

How to Get the Best Malpractice Coverage in Tennessee

Here’s how to secure solid malpractice coverage in Tennessee without overpaying:

- Work with a broker who understands Tennessee’s medical malpractice statutes, especially the caps, exceptions, and filing requirements.

- Gather multiple quotes from carriers that serve Tennessee (both national names and regional insurers).

- Review your current coverage details, limits, policy type, and tail/or occurrence status, to see if they align with your current risk.

- Ask about possible discounts or risk mitigation credits (e.g., for clean claims history, hospital affiliations, safety protocols).

- Revisit your policy at renewal, market changes, legal precedents, and insurer appetites can shift, and what was competitive last year might not be now.

Historic Medical Malpractice Insurance Rates in Tennessee for Physicians.

Frequently Asked Questions: Tennessee Medical Malpractice Insurance

Q: Is malpractice insurance legally required in Tennessee?

No. There’s no state law forcing physicians to carry malpractice insurance, but in most cases, hospitals and health facilities require it for credentialing, employment, or admitting privileges.

Q: What are the limits on noneconomic damages?

Tennessee law limits noneconomic damages to $750,000 per injured plaintiff under most circumstances. For “catastrophic injuries,” that cap increases to $1,000,000. Cases involving fraud, intentional misconduct, or other serious exceptions may bypass these limits.

Q: How long do I have to file a malpractice claim in Tennessee?

Typically you will have one year from the date of injury or from when the injury was discovered. In addition, there is an absolute deadline of three years from the date the act occurred. Some exceptions apply for minors, fraud, or foreign objects.

Q: Do I need tail coverage in Tennessee?

Yes, if you have a claims‑made policy and you leave your current insurer, change roles, or retire. Occurrence policies don’t require tail coverage, but they usually cost more upfront.

Get a Quote from All Major Tennessee Carriers

We work with:

- Medical Protective

- The Doctors Company

- NORCAL

- ProAssurance

- State Volunteer

- Lexington Insurance Co.

One form. Every top carrier. Your best rate, without the hassle.

Resources for Tennessee Physicians.

Tennessee Medical Association

Medical Malpractice Insurance Guide

Tennessee Department of Commerce and Insurance

Tennessee Department of Health: Licensure Verification

Tennessee Osteopathic Medical Association

TennCare

All MD Tennessee Healthcare Defense Attorney Listing