Start Your Custom Quote Process™

Malpractice Insurance for Doctors & Physicians in South Dakota

Let our specialists compare medical malpractice insurance quotes for your practice in South Dakota

Our partners

Table of Contents

- Medical Liability Claims Trends for South Dakota Healthcare Providers

- How to buy medical malpractice insurance in South Dakota.

- How to save money on your malpractice insurance.

- How much does medical malpractice insurance cost in South Dakota?

- Medical malpractice requirements in South Dakota.

- Find Coverage for your Practice

- Client Testimonials

- Best medical malpractice insurance companies in South Dakota.

- Why partner with Cunningham Group in South Dakota?

- Historic medical malpractice insurance rates in South Dakota – since 2000.

- History of malpractice insurance in South Dakota.

- Resources for Physicians.

South Dakota Malpractice Insurance

Malpractice insurance rates in South Dakota are among the lowest in the nation. The state’s market is dominated MMIC Insurance Inc., which insures more than two-thirds of South Dakota’s physicians. Other insurers are present in the market, however, and rates can be competitive as these companies try to gain a greater market share.

Our 2023 Physician Buyers Guide for purchasing malpractice insurance in South Dakota gives you the information necessary to obtain the strongest, most financially secure policy at the best price. When shopping for coverage, you need a full view of the South Dakota marketplace to find the company that best fits your situation. Choose a broker that can offer multiple quotes from all the major companies in South Dakota that offer coverage for physicians.

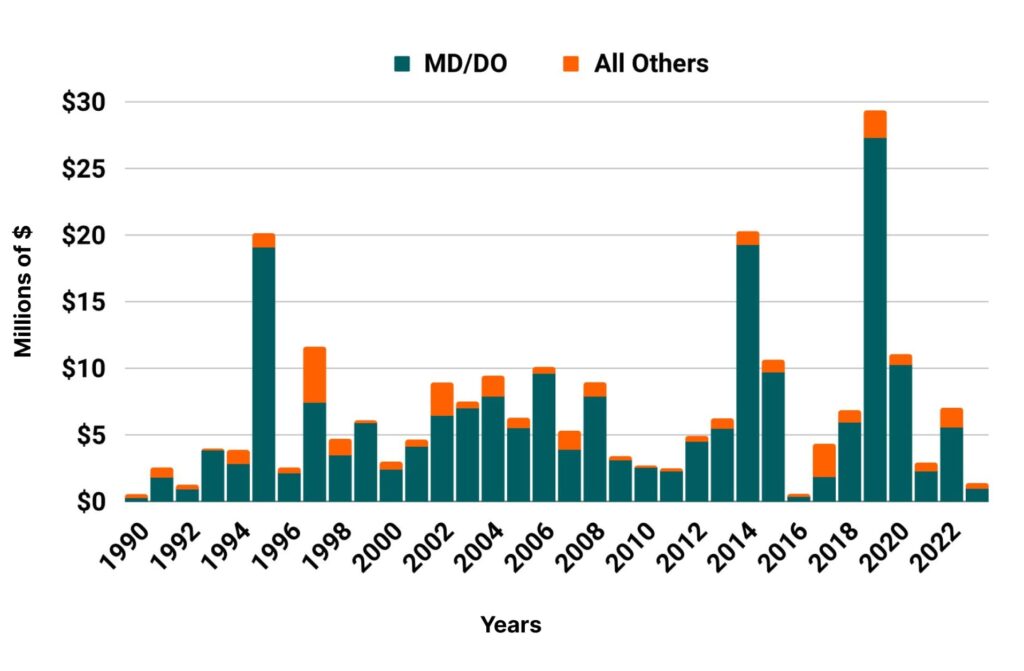

Medical Liability Claims Trends for South Dakota Healthcare Providers

South Dakota NPDB from 1990 to 2023

How to buy malpractice insurance in South Dakota.

The best way to buy malpractice coverage is to work with a reputable malpractice insurance broker in South Dakota who can generate multiple quotes. Your broker will walk you through the lengthy insurance application and underwriting process. Click to get medical malpractice insurance quotes from every major South Dakota malpractice insurance company.

Typically, the malpractice insurance purchasing process goes like this:

- Submit your information for your free medical malpractice insurance quote from every major insurance company in South Dakota.

- One of our veteran malpractice insurance agents who specializes in the South Dakota market will contact you to learn more about your specific needs.

- We shop your coverage to every major insurance company in South Dakota.

- We present you with a number of insurance quotes and give you the information necessary to make an educated and informed decision. Don’t worry. We’re here every step of the way, helping you get the best price with the best company.

- At renewal time, we restart the process of shopping your coverage among every major carrier to keep your policy properly priced.

How to save money on your malpractice insurance.

- The easiest way to save money on your medical malpractice insurance policy is by working with a broker who has the access to generate quotes from every major insurance company, offering an accurate view of the marketplace. As one of the top brokers in South Dakota, we can guide you through the application and underwriting process so you’re confident you secured the best price with the right insurer for your situation.

- The most common limits in South Dakota are $1 million/$3 million. Limits of liability play a major role in determining the overall cost of your policy. Some companies will offer lower limits to save you money. We don’t recommend this. We want your risks fully indemnified so you never have to pay an award out of pocket. Let us save you money by shopping your coverage rather than skimp on protection.

- Check out our 7 secrets your medical malpractice insurance agent won’t tell you page to get insider information on buying coverage in South Dakota.

How much does medical malpractice insurance cost in South Dakota.

Rates for physician malpractice insurance don’t vary much depending on where you practice within the state. Most major insurance companies classify South Dakota as a single territory, which means your specialty’s base rate does not vary depending on your practice address. But you still want multiple quotes to get an accurate view of the marketplace. This is one of the many reasons it’s important to work with an insurance agency that specializes in medical malpractice insurance. Below are mature, base rates with no credits or discounts. We typically get our clients a 30-50% reduction from these rates:

South Dakota

- Internal Medicine Average Rate $4,289

- General Surgeon Average Rate $4,326

- OB/gyn – Average Rate $19,661

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Medical malpractice requirements in South Dakota.

Limits of Liability: The most common limits of liability in South Dakota are $1 million per claim with an annual aggregate cap of $3 million.

Most hospitals require a physician carry malpractice insurance prior to granting admitting privileges. Some of the hospital systems requiring this include, but are not limited to, Avera McKennan Hospital & University Health Center in Sioux Falls, Monument Health Rapid City Hospital and Dunes Surgery Hospital in Dakota Dunes.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Plastic Surgeon in South DakotaThank you so much for completing this in an amazingly timely and efficient manner. You and your team have done an amazing job in both obtaining the best coverage for the lowest price from an A+ rated company as well as shortening the turnaround time to almost nil. I cannot thank you enough.

OB in South DakotaAs an Obstetrician, finding a decent tail policy turn out to be an arduous task until I talked with Cunningham Group. They solved my problem in just a number of days where the other brokers were taking weeks. Very glad for their services.

Best Medical malpractice insurance companies in South Dakota.

- The Doctors Company

- Coverys

- Lexington

- American Casualty Co.

- Continental Casualty

Why partner with Cunningham Group?

Partnering with Cunningham Group will give you a full view of the South Dakota marketplace.. Our veteran insurance agents average 10+ years of industry experience. Let us help you secure medical malpractice insurance quotes from every major insurance company in South Dakota.

Historic Medical Malpractice Insurance Rates in South Dakota for Physicians.

Brief History and other important facts of medical malpractice insurance in South Dakota.

The medical malpractice climate continues to improve in South Dakota. The state’s Department of Insurance recently announced that medical liability insurance companies reported less than $2 million in settlements for malpractice claims in 2016, less than half of what they were in 2015.

Tort Reform in South Dakota

South Dakota has made several reforms to its medical liability system. Arguably the most important of these is a $500,000 cap on noneconomic damages, which was established in 1985. Other reforms include expert testimony requirements, collateral source reform and the establishment of voluntary arbitration, which allows for an arbitration panel to determine the existence of liability and then gives the parties 30 days to agree on damages. If the parties cannot agree, then the panel makes a determination.

Resources for South Dakota Physicians.

South Dakota State Medical Association

South Dakota Division of Insurance

South Dakota Association of Health Care Organizations

South Dakota Board of Medical and Osteopathic Examiners

South Dakota Osteopathic Association

All MD South Dakota Healthcare Defense Attorney Listing

Medical Malpractice Insurance Guide