Start Your Custom Quote Process™

Malpractice Insurance for Doctors & Physicians in Oregon

Let our specialists compare medical malpractice insurance quotes for your practice in Oregon

Our partners

Table of Contents

- Medical Liability Claims Trends for Oregon Healthcare Providers

- How to buy medical malpractice insurance in Oregon.

- How to save money on your malpractice insurance.

- How much does medical malpractice insurance cost in Oregon?

- Medical malpractice requirements in Oregon.

- Find Coverage for your Practice

- Client Testimonials

- Best medical malpractice insurance companies in Oregon.

- Why partner with Cunningham Group in Oregon?

- Historic medical malpractice insurance rates in Oregon – since 2000.

- History of malpractice insurance in Oregon.

- Resources for Physicians.

Oregon Malpractice Insurance

Malpractice insurance rates in Oregon are relatively moderate. The state is known for having a low level of litigation compared to other states, which helps keep premiums low.

Our 2023 Physician Buyers Guide for purchasing malpractice insurance in Oregon gives you the information necessary to obtain the strongest, most financially secure policy at the best price. When shopping for coverage, you need a full view of the Oregon marketplace to find the company that best fits your situation. Choose a broker that can offer multiple quotes from all the major malpractice insurance companies in Oregon.

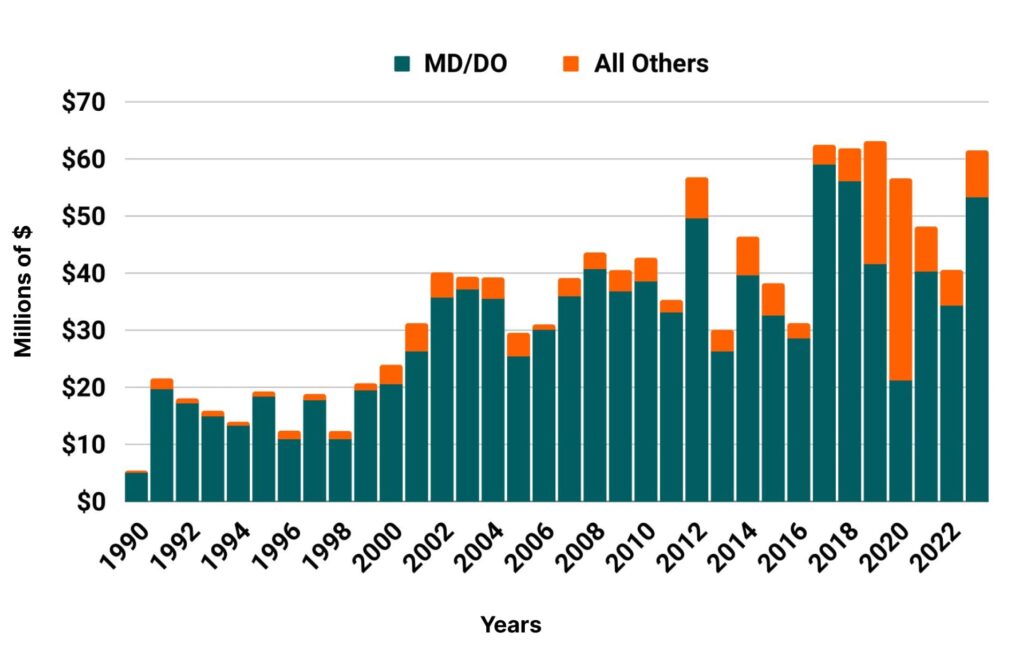

Medical Liability Claims Trends for Oregon Healthcare Providers

Oregon NPDB from 1990 to 2023

How to buy malpractice insurance in Oregon.

The best way to buy malpractice coverage is to work with a reputable malpractice insurance broker in Oregon who can generate multiple quotes. Your broker will walk you through the lengthy insurance application and underwriting process. Click to get medical malpractice insurance quotes from every major Oregon malpractice insurance company.

Typically, the malpractice insurance purchasing process goes like this:

- Submit your information for your free medical malpractice insurance quote from every major insurance company in Oregon.

- One of our veteran malpractice insurance agents who specializes in the Oregon market will contact you to learn more about your specific needs.

- We shop your coverage to every major insurance company in Oregon.

- We present you with a number of insurance quotes and give you the information necessary to make an educated and informed decision. Don’t worry. We’re here every step of the way, helping you get the best price with the best company.

- At renewal time, we restart the process of shopping your coverage among every major carrier to keep your policy properly priced.

How to save money on your malpractice insurance.

- The easiest way to save money on your medical malpractice insurance policy is by working with a broker who has the access to generate quotes from every major insurance company, offering an accurate view of the marketplace. As one of the top brokers in Oregon, we can guide you through the application and underwriting process so you’re confident you secured the best price with the right insurer for your situation.

- The most common limits in Oregon are $1 million/$3 million. Limits of liability play a major role in determining the overall cost of your policy. Some companies will offer lower limits to save you money. We don’t recommend this. We want your risks fully indemnified so you never have to pay an award out of pocket. Let us save you money by shopping your coverage rather than skimp on protection.

- Check out our 7 secrets your medical malpractice insurance agent won’t tell you page to get insider information on buying coverage in Oregon.

How much does medical malpractice insurance cost in Oregon?

Rates for physician malpractice insurance don’t vary much depending on where you practice within the state. Most major insurance companies classify Oregon as a single territory, which means your specialty’s base rate does not vary depending on your practice address. But you still want multiple quotes to get an accurate view of the marketplace. This is one of the many reasons it’s important to work with an insurance agency that specializes in medical malpractice insurance. Below are mature, base rates with no credits or discounts. We typically get our clients a 30-50% reduction from these rates:

Oregon

- Internal Medicine Average Rate $7,610

- General Surgeon Average Rate $26,531

- OB/gyn – Average Rate $35,171

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Medical malpractice requirements in Oregon.

Limits of Liability: The most common limits of liability in Oregon are $1 million per claim with an annual aggregate cap of $3 million.

Most hospitals require a physician carry malpractice insurance prior to granting admitting privileges. Some of the hospital systems requiring this include, but are not limited to, Legacy Emanuel Medical Center in Portland, PeaceHealth Sacred Heart in Springfield and Salem Hospital.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Family Practice in OregonReceived my COI and wish to thank you very much for your prompt and courteous service in obtaining the coverage that I need at a very reasonable price. I will have no reservation in referring your company and your services to my colleagues.

Best Medical malpractice insurance companies in Oregon.

- The Doctors Company

- Medical Protective

- NORCAL

- Coverys

- Physicians Insurance Mutual

- Continental Casualty

Why partner with Cunningham Group?

Partnering with Cunningham Group will give you a full view of the Oregon marketplace.. Our veteran insurance agents average 10+ years of industry experience. Let us help you secure medical malpractice insurance quotes from every major insurance company in Oregon.

Historic Medical Malpractice Insurance Rates in Oregon for Physicians.

Brief History and other important facts of medical malpractice insurance in Oregon.

Oregon made its first major tort reforms in the 1987, passing a $500,000 cap on noneconomic damages and limiting joint-and-several liability. In 1995, additional reforms were passed, which included limits on attorney contingency fees; mandated arbitration for most cases involving less than $50,000; encouraged settlement conferences; penalized frivolous lawsuits, poorly-prepared court documents and motions; mandated attorney fee and court cost awards in certain cases and provided criteria for the discretionary awarding of court costs and attorney fees in a wide variety of other cases; modified punitive damage awards; and limited the attorney share for punitive damage awards to 20 percent.

In 1999, Oregon’s Supreme Court overturned the state’s cap on noneconomic damages for personal injury cases, but allowed to stand the cap in cases of wrongful death, including for medical malpractice actions. But in 2016, the Oregon Supreme Court effectively reinstated the personal injury noneconomic damage cap in a case regarding an eight month old who was left with lifelong health problems after a surgery. In response, the Oregon legislature introduced two bills to raise the noneconomic damage cap. Neither became law, but momentum is gaining to pass them in coming sessions.

Resources for Oregon Physicians

Oregon Medical Association

Medical Malpractice Insurance Guide

Department of Consumer and Business Services

Oregon Association of Hospitals and Health Systems

Oregon Medical Board

Osteopathic Physicians and Surgeons of Oregon

All MD Oregon Healthcare Defense Attorney Listing