Start Your Custom Quote Process™

Medical Malpractice Insurance for Oregon

Compare Quotes from Every Major Medical Malpractice Carrier in Oregon

Our partners

Table of Contents

- Medical Liability Claims Trends for Oregon Healthcare Providers

- Malpractice Insurance Requirements for Oregon Physicians

- Why Malpractice Insurance Still Matters in Oregon

- What Factors Impact Malpractice Insurance Rates in Oregon?

- Client Testimonials

- How to Get the Best Malpractice Coverage in Oregon

- Historic Medical Malpractice Insurance Rates in Oregon for Physicians.

- Frequently Asked Questions: Oregon Medical Malpractice Insurance

- Get a Quote from All Major Oregon Carriers

- Resources for Physicians.

What Medical Professionals in Oregon Should Know About Malpractice Coverage

Oregon’s malpractice market stands out for its historical tort reform and today’s comparatively stable environment. The state implemented caps on noneconomic damages and streamlined claim processes decades ago. Still, practicing in Oregon means facing evolving legal precedents and regional risk levels, whether in urban centers like Portland or rural communities. Malpractice coverage is essential for continuity and professional protection.

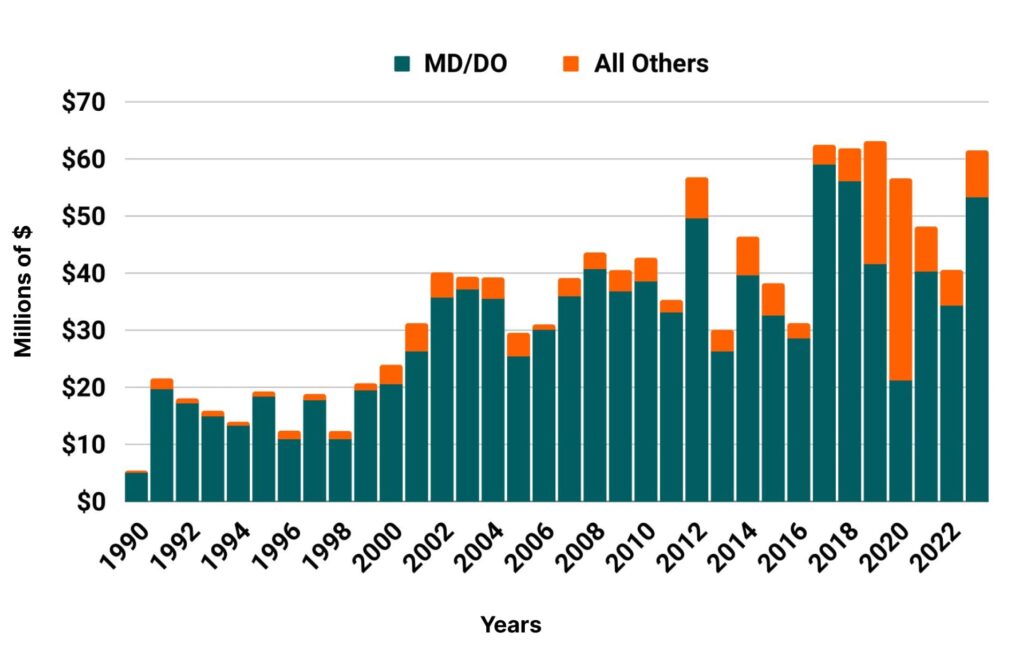

Medical Liability Claims Trends for Oregon Healthcare Providers

Oregon NPDB from 1990 to 2023

Malpractice Insurance Requirements for Oregon Physicians

While Oregon doesn’t legally mandate malpractice insurance, virtually all hospitals and healthcare systems, including Legacy Emanuel, PeaceHealth Sacred Heart, and Salem Hospital, require coverage for credentialing and employment. Standard policy limits are $1 million per claim / $3 million aggregate annually, which aligns with industry norms and ensures smooth access to care networks.

Why Malpractice Insurance Still Matters in Oregon

Despite earlier legal reforms, Oregon physicians still face litigation risk, from large jury awards to drawn-out defense costs. Legal changes such as periodic payments for future damages and limits on attorney fees have helped stabilize the environment, but a single claim can still disrupt a practice without coverage. Malpractice insurance offers both financial protection and continuity, helping physicians focus on patient care, not courtrooms.

What Factors Impact Malpractice Insurance Rates in Oregon?

Though Oregon is generally rated as a single territory, premiums are shaped by:

- Specialty Risk: Procedural specialties typically carry higher premiums.

- Policy Type: Claims-made policies are most common, but require tail coverage; occurrence policies cost more but don’t require tail.

- Claims History: A prior claim, even resolved quickly, can elevate premiums.

- Coverage Levels: Higher limits deliver stronger protection, but at a higher cost.

- Workload & Practice Type: Surgery-heavy or high-volume practices typically face higher premiums.

Shopping across carriers helps ensure your policy fits your practice and budget, not a one-size-fits-all model.

Oregon

- Internal Medicine Average Rate $7,610

- General Surgeon Average Rate $26,531

- OB/gyn – Average Rate $35,171

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Family Practice in OregonReceived my COI and wish to thank you very much for your prompt and courteous service in obtaining the coverage that I need at a very reasonable price. I will have no reservation in referring your company and your services to my colleagues.

How to Get the Best Malpractice Coverage in Oregon

Oregon’s insurance market includes both national and regional carriers, such as The Doctors Company, Medical Protective, NORCAL, and Physicians Insurance Mutual, creating competition and opportunity. We help physicians navigate this landscape by:

- Gathering quotes from all active insurers

- Clarifying differences between policies and cost structures

- Identifying discount or risk-management credits when available

- Managing renewals to ensure continued value and fit

Clients in Oregon frequently achieve 30–50% savings compared to direct quotes, without reducing coverage quality.

Historic Medical Malpractice Insurance Rates in Oregon for Physicians.

Frequently Asked Questions: Oregon Medical Malpractice Insurance

Is malpractice insurance required in Oregon?

No state mandate, but most hospitals require coverage for credentialing.

What are the typical policy limits?

$1 million per claim / $3 million yearly aggregate is the standard benchmark.

Does location affect premiums?

Not much, Oregon is mostly rated as a single territory. However, individual risk factors influence premium costs more than location alone.

Need tail coverage?

Yes, if you’re on a claims-made policy and change jobs or retire. Occurrence policies eliminate that need, but come with higher upfront cost.

How can I reduce premiums without sacrificing protection?

Work with a broker who compares carriers and helps identify savings opportunities based on your profile, not by cutting coverage.

Get a Quote from All Major Oregon Carriers

- The Doctors Company

- Medical Protective

- NORCAL

- Coverys

- Physicians Insurance Mutual

- Continental Casualty

One form. Every top carrier. Your best rate, without the hassle.

Resources for Oregon Physicians

Oregon Medical Association

Medical Malpractice Insurance Guide

Department of Consumer and Business Services

Oregon Association of Hospitals and Health Systems

Oregon Medical Board

Osteopathic Physicians and Surgeons of Oregon

All MD Oregon Healthcare Defense Attorney Listing