Start Your Custom Quote Process™

Malpractice Insurance for Doctors & Physicians in North Carolina

Let our specialists compare medical malpractice insurance quotes for your practice in North Carolina

Our partners

Table of Contents

- Medical Liability Claims Trends for North Carolina Healthcare Providers

- How much does medical malpractice insurance cost in North Carolina?

- Purchasing North Carolina Medical Malpractice Insurance

- Medical Malpractice Insurance Costs in North Carolina

- Find Coverage for your Practice

- Client Testimonials

- Factors that Affect Malpractice Insurance Premiums:

- Why North Carolina Doctors Choose Cunningham Group

- How Does the Process Work?

- Historic medical malpractice insurance rates in North Carolina – since 2000.

- North Carolina Medical Malpractice & Tort Reform’s Effect on Settling Disputes

- Resources for Physicians.

North Carolina Malpractice Insurance

Every interaction and healthcare decision a medical professional makes that impacts a patient’s care, puts them at risk for a malpractice claim. North Carolina physicians should carry medical malpractice insurance. Medical malpractice lawsuits can be filed in North Carolina for a few different conflicts including treatment discrepancies, perceived lack of treatment and other claimed departures from accepted North Carolina standards of medical care. As with any lawsuit, there must be proof that harm resulted from a North Carolina healthcare professional’s negligence. Learn more about North Carolina’s malpractice insurance requirements and how you can find optimal coverage for your unique needs.

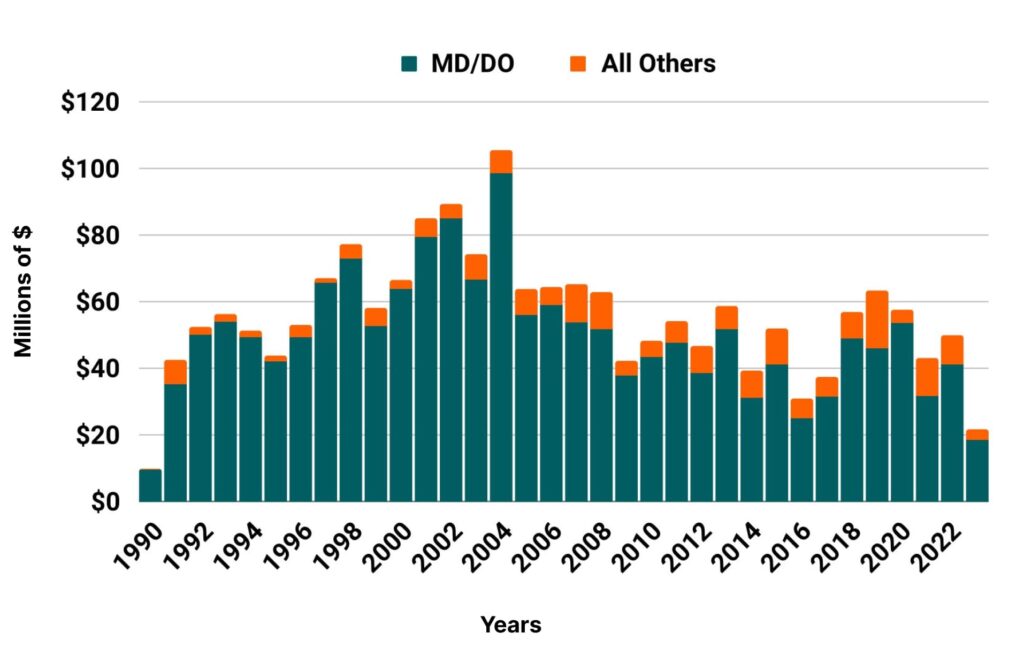

Medical Liability Claims Trends for North Carolina Healthcare Providers

North Carolina NPDB from 1990 to 2023

How much does medical malpractice insurance cost in North Carolina?

Rates for physician malpractice insurance don’t vary much depending on where you practice within the state. Most major insurance companies classify North Carolina as a single territory, which means your specialty’s base rate does not vary depending on your practice address. But you still want multiple quotes to get an accurate view of the marketplace. This is one of the many reasons it’s important to work with an insurance agency that specializes in medical malpractice insurance. Below are mature, base rates with no credits or discounts. We typically get our clients a 30-50% reduction from these rates:

North Carolina

- Internal Medicine Average Rate $8,303

- General Surgeon Average Rate $26,897

- OB/gyn – Average Rate $40,788

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Purchasing North Carolina Medical Malpractice Insurance

The best way to buy medical malpractice coverage is to work with a reputable licensed North Carolina malpractice insurance broker. Medical malpractice brokers are capable of generating multiple quotes specific for your unique needs. This allows you to pick the best coverage at the best price. Your broker will also walk you through the lengthy insurance application and underwriting process. View medical malpractice insurance quotes from every major North Carolina malpractice insurance company.

Our 2022 Physician Buyers Guide for purchasing malpractice insurance in North Carolina gives you the information necessary to obtain the strongest, most financially secure policy at the best price. When shopping for coverage, you need a full view of the North Carolina marketplace to find the company that best fits your situation. Choose a broker that can offer multiple quotes from all the major malpractice insurance companies in North Carolina.

Medical Malpractice Insurance Costs in North Carolina

Rates for physician malpractice insurance don’t vary much depending on where you practice within the state. Most major insurance companies classify North Carolina as a single territory, which means your specialty’s base rate does not vary depending on your practice address. It is still very important to work with an insurance agency licensed in North Carolina that specializes in medical malpractice insurance.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

PM&R in North CarolinaObtaining medical malpractice insurance for the first time was daunting; however Mr. Leander made this experience approachable, easy and streamlined. I would definitely recommend his services to my colleagues or anyone with uncertainties as a first time practicing physician.

Factors that Affect Malpractice Insurance Premiums:

Amount of coverage needed

- More coverage means a higher premium

Type of policy preferred

- Every policy is different, every medical practitioner has different needs

Medical specialty

- Higher-risk specialties that require unique expertise will naturally have higher premiums

- Working hours

- Longer working hours ( more strained individuals) will have higher premiums

- Previous malpractice claims history

- If you have a history of claims, insurance companies will see you as a higher risk and require a higher premium to cover you

Why North Carolina Doctors Choose Cunningham Group

North Carolina physicians choose Cunningham Group because we are one of the few medical malpractice insurance agencies that take the time to understand your specific employment situation and your approach to patient care. With access to every major medical malpractice insurance company in North Carolina, our team is uniquely qualified to get you the best coverage at the most affordable price. Most agents only have access to one or two medical malpractice insurance companies. Our almost-universal access lets us shop your coverage among nearly every available company, which means malpractice insurers compete for your business.

How Does the Process Work?

- You will submit your information through a secure medical malpractice insurance quote form.

- You can always call us and speak to an agent immediately.

- A veteran medical malpractice insurance broker in North Carolina will be assigned to you.

- We shop your Physician Malpractice Insurance to every major malpractice insurance in North Carolina.

- Your North Carolina agent will take the time and go over all of your options with you, explaining everything to make certain you make the right decision.

- We get you your insurance policy at the best price with a major insurance company.

- At renewal time: We start the shopping process all over again, getting you quotes from all the major malpractice insurance companies to again make certain you’re properly priced.

Request your free medical malpractice insurance quote and learn why more people choose us over anyone else in the nation.

Historic Medical Malpractice Insurance Rates in North Carolina for Physicians.

North Carolina Medical Malpractice & Tort Reform’s Effect on Settling Disputes

North Carolina has instituted several reforms to its medical liability system over the years. It was among the first states to adopt alternative dispute resolution, which can offer a simpler means of settling disputes. These alternatives include mediation, arbitration, a summary jury trial, and early neutral evaluation. North Carolina first began testing these methods in 1991, establishing a series of pilot programs that required the mediation of civil actions. This system was effective in reducing both the length of the conflict and the overall costs.

In 2001, a law capping noneconomic damages at $500,000 for medical malpractice cases was passed. The law made exceptions if the plaintiff suffered disfigurement, loss of use of part of the body, permanent injury, or death, as well as if the defendant was found to have been reckless, grossly negligent, fraudulent, or committed the acts with intent or malice. The North Carolina damage cap is indexed to inflation.

In 2007, the North Carolina General Assembly passed the Voluntary Arbitration of Health Claims Act, which capped total damages at $1 million in medical professional liability claims where both parties agreed to use binding arbitration. The act created a well-defined system of alternative dispute resolution for medical liability cases, allowing medical malpractice insurance providers to offer more stability in premiums.

Resources for North Carolina Physicians

North Carolina Medical Society

Medical Malpractice Insurance Guide

North Carolina Department of Insurance

North Carolina Hospital Association

North Carolina Medical Board

North Carolina Osteopathic Medical Association

North Carolina Medicaid

All MD North Carolina Healthcare Defense Attorney Listing