Start Your Custom Quote Process™

Medical Malpractice Insurance for North Carolina Physicians

Compare Quotes from Every Major Medical Malpractice Carrier in North Carolina

Our partners

Table of Contents

- Medical Liability Claims Trends for North Carolina Healthcare Providers

- Malpractice Insurance Requirements for North Carolina Physicians

- Why Malpractice Insurance Still Matters in North Carolina

- What Factors Impact Malpractice Insurance Rates in North Carolina?

- Client Testimonials

- How to Get the Best Malpractice Coverage in North Carolina

- Historic Medical Malpractice Insurance Rates in North Carolina for Physicians.

- Frequently Asked Questions: North Carolina Medical Malpractice Insurance

- Get a Quote from All Major North Carolina Carriers

- Resources for Physicians.

What Medical Professionals in North Carolina Should Know About Malpractice Coverage

In North Carolina, malpractice insurance isn’t mandated by law, but the practical landscape makes it essential. Hospitals almost always require coverage for credentialing, and the state’s litigation activity, while more moderate than some, is still significant. With evolving tort reform, nuanced legal developments, and a wide mix of carriers, having tailored malpractice protection is a must for every physician.

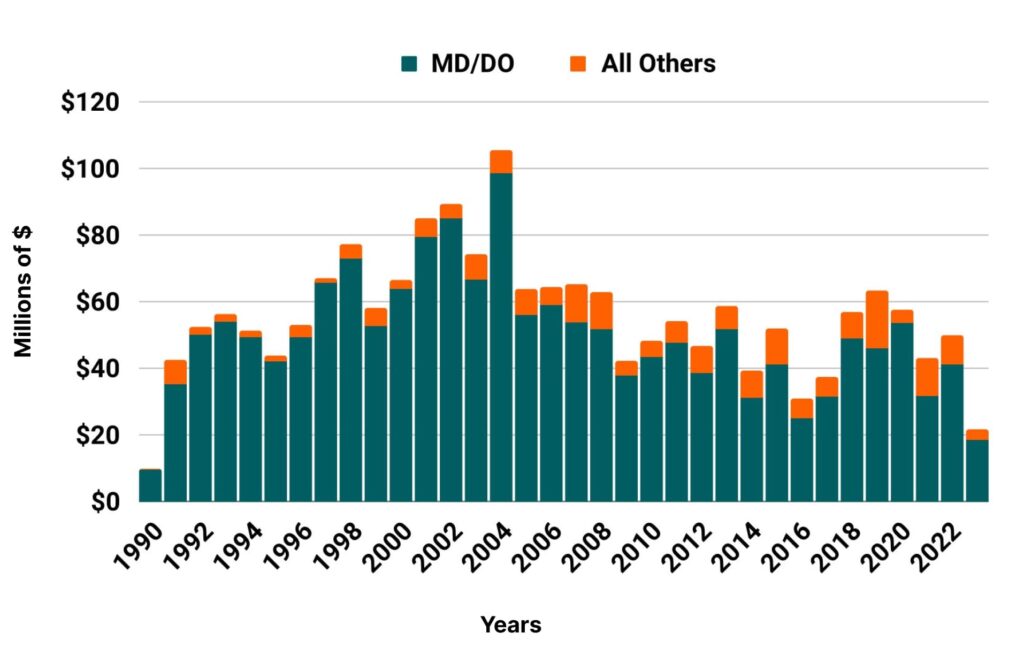

Medical Liability Claims Trends for North Carolina Healthcare Providers

North Carolina NPDB from 1990 to 2023

Malpractice Insurance Requirements for North Carolina Physicians

Although state law doesn’t require malpractice insurance, most hospitals and health systems, including Duke, UNC Health, and Atrium, expect physicians to maintain active policies. These typically align with $1 million per claim / $3 million aggregate limits. Maintaining proper coverage ensures compliance with credentialing and protects your practice operations.

North Carolina

- Internal Medicine Average Rate $8,303

- General Surgeon Average Rate $26,897

- OB/gyn – Average Rate $40,788

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Why Malpractice Insurance Still Matters in North Carolina

North Carolina has seen positive legal trends, like caps on non-economic damages and expanded alternative dispute resolution, but risk remains. Jury awards can still reach significant amounts, and medical decisions can be second-guessed long after they’re made. Whether it’s defending against a claim or simply credentialing smoothly, malpractice insurance provides essential protection and continuity.

What Factors Impact Malpractice Insurance Rates in North Carolina?

Even though most carriers rate North Carolina as a single territory, premiums reflect personalized risk factors, including:

- Specialty: Specialties like OB/GYN or surgery often carry higher premiums.

- Policy Type: Claims-made policies are common but may require tail coverage; occurrence policies avoid tail but cost more upfront.

- Claims History: A clean record is beneficial; prior claims elevate risk and rate.

- Workload: Full-time practice equals more exposure.

- Coverage Limits: Higher limits offer greater protection, with a corresponding cost increase.

| Specialty | Average Annual Premium Range* | Risk Level | Why Rates Are Higher |

| OB/GYN | $35,000 – $50,000+ | Very High | High frequency and severity of birth-related claims make this the costliest specialty in NC. |

| Orthopedic Surgery | $25,000 – $35,000 | High | Exposure to joint replacements, spine surgery, and trauma care drives up premiums. |

| General Surgery | $20,000 – $30,000 | High | Broad surgical scope increases risk of complications and claims. |

| Neurosurgery | $50,000 – $70,000+ | Very High | Among the highest nationwide due to catastrophic claim potential. |

| Emergency Medicine | $18,000 – $25,000 | High | High-volume, unpredictable cases and limited patient history elevate risk. |

| Anesthesiology | $15,000 – $22,000 | High | Liability tied to perioperative complications, airway issues, and critical events. |

Shopping across multiple carriers helps ensure you’re not overpaying, especially given how much standalone quotes can vary.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

PM&R in North CarolinaObtaining medical malpractice insurance for the first time was daunting; however Mr. Leander made this experience approachable, easy and streamlined. I would definitely recommend his services to my colleagues or anyone with uncertainties as a first time practicing physician.

How to Get the Best Malpractice Coverage in North Carolina

North Carolina’s market includes national insurers, like The Doctors Company, Medical Protective, and ProAssurance, as well as regional leaders. What matters is how you engage with it:

- We compare all major carriers on your behalf.

- We clarify your options, policy types, limits, and cost trade-offs are explained simply.

- We flag discounts, risk management credits, or practice-specific incentives.

- We re-shop at each renewal to keep your policy appropriately priced.

That’s how many of our clients save 30–50% compared to single-carrier pricing, without sacrificing coverage.

Historic Medical Malpractice Insurance Rates in North Carolina for Physicians.

Frequently Asked Questions: North Carolina Medical Malpractice Insurance

Is malpractice insurance required by law in North Carolina?

No, but in most cases, hospitals require it to grant admitting privileges, and it’s vital for professional security.

What are typical coverage limits?

$1 million per claim / $3 million annual aggregate is the standard.

Do rates vary based on geographic location?

Not significantly, most insurers rate North Carolina as a unified territory. Still, your personal factors influence pricing more than location.

Do I need tail coverage?

Yes, if you’re on a claims-made policy and are retiring or changing jobs. Occurrence policies eliminate that need, but come at a steeper cost.

How can I ensure I’m getting the best rate without sacrificing protection?

Work with a brokerage that understands North Carolina’s malpractice landscape and can shop your coverage across all major carriers.

Get a Quote from All Major North Carolina Carriers

We work with a large number of trusted carriers and are ready to make sure you get the best policy for your needs.

One form. Every top carrier. Your best rate, without the hassle.

Resources for North Carolina Physicians

North Carolina Medical Society

Medical Malpractice Insurance Guide

North Carolina Department of Insurance

North Carolina Hospital Association

North Carolina Medical Board

North Carolina Osteopathic Medical Association

North Carolina Medicaid

All MD North Carolina Healthcare Defense Attorney Listing