Start Your Custom Quote Process™

Malpractice Insurance for Doctors & Physicians in Missouri

Let our specialists compare medical malpractice insurance quotes for your practice in Missouri

Our partners

Table of Contents

- Medical Liability Claims Trends for Missouri Healthcare Providers

- How to buy medical malpractice insurance in Missouri.

- How to save money on your malpractice insurance.

- How much does medical malpractice insurance cost in Missouri?

- Medical malpractice requirements in Missouri.

- Find Coverage for your Practice

- Client Testimonials

- Best medical malpractice insurance companies in Missouri.

- Why partner with Cunningham Group in Missouri?

- Historic medical malpractice insurance rates in Missouri – since 2000.

- History of malpractice insurance in Missouri.

- Resources for Physicians.

Missouri Malpractice Insurance

Missouri physicians pay relatively moderate premiums for their medical malpractice insurance, especially when compared to its neighbors to the east. The difference in malpractice insurance cost will vary greatly between the different medical malpractice insurance companies available.

Our 2023 Physician Buyers Guide for purchasing malpractice insurance in Missouri gives you the information necessary to obtain the strongest, most financially secure policy at the best price. When shopping for coverage, you need a full view of the Missouri marketplace to find the company that best fits your situation. Choose a broker that can offer multiple quotes from all the major malpractice insurance companies in Missouri.

Medical Liability Claims Trends for Missouri Healthcare Providers

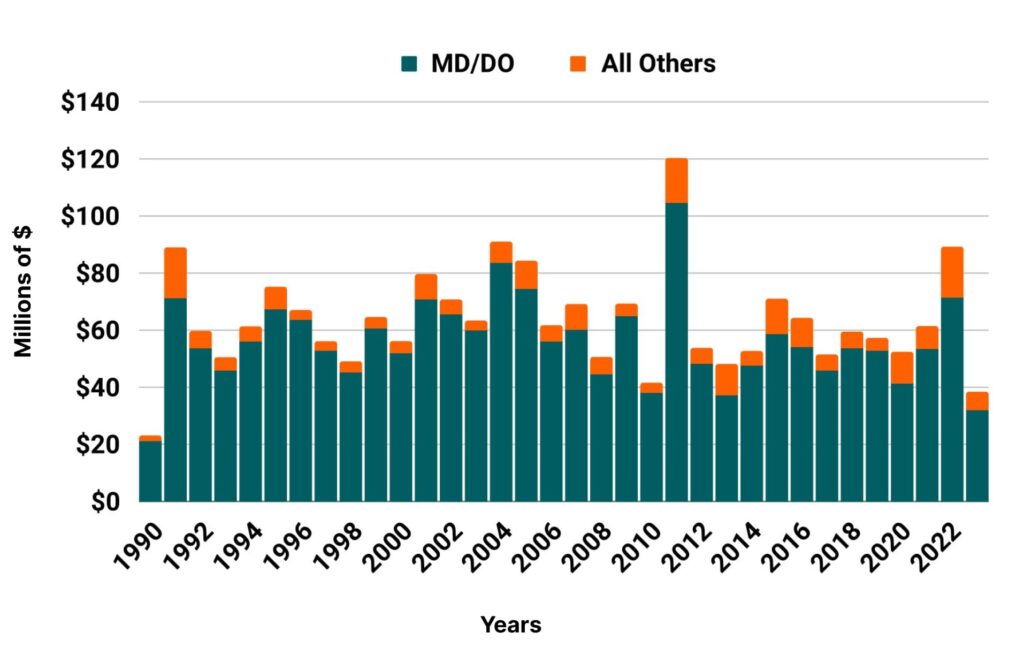

Missouri NPDB from 1990 to 2023

How to buy malpractice insurance in Missouri.

The best way to buy malpractice coverage is to work with a reputable malpractice insurance broker in Missouri who can generate multiple quotes. Your broker will walk you through the lengthy insurance application and underwriting process. Click to get medical malpractice insurance quotes from every major Missouri malpractice insurance company.

Typically, the malpractice insurance purchasing process goes like this:

- Submit your information for your free medical malpractice insurance quote from every major insurance company in Missouri.

- One of our veteran malpractice insurance agents who specializes in the Missouri market will contact you to learn more about your specific needs.

- We shop your coverage to every major insurance company in Missouri.

- We present you with a number of insurance quotes and give you the information necessary to make an educated and informed decision. Don’t worry. We’re here every step of the way, helping you get the best price with the best company.

- At renewal time, we restart the process of shopping your coverage among every major carrier to keep your policy properly priced.

How to save money on your malpractice insurance.

- The easiest way to save money on your medical malpractice insurance policy is by working with a broker who has the access to generate quotes from every major insurance company, offering an accurate view of the marketplace. As one of the top brokers in Missouri, we can guide you through the application and underwriting process so you’re confident you secured the best price with the right insurer for your situation.

- The most common limits in Missouri are $1 million/$3 million. Limits of liability play a major role in determining the overall cost of your policy. Some companies will offer lower limits to save you money. We don’t recommend this. We want your risks fully indemnified so you never have to pay an award out of pocket. Let us save you money by shopping your coverage rather than skimp on protection.

- Check out our 7 secrets your medical malpractice insurance agent won’t tell you page to get insider information on buying coverage in Missouri.

How much does medical malpractice insurance cost in Missouri?

Rates for physician malpractice insurance don’t vary much depending on where you practice within the state. Most major insurance companies classify Missouri as a single territory, which means your specialty’s base rate does not vary depending on your practice address. But you still want multiple quotes to get an accurate view of the marketplace. This is one of the many reasons it’s important to work with an insurance agency that specializes in medical malpractice insurance. Below are mature, base rates with no credits or discounts. We typically get our clients a 30-50% reduction from these rates:

Missouri

- Internal Medicine Average Rate $9,574

- General Surgeon Average Rate $28,723

- OB/gyn – Average Rate $43,882

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Medical malpractice requirements in Missouri.

Limits of Liability: The most common limits of liability in Missouri are $1 million per claim with an annual aggregate cap of $3 million.

Most hospitals require a physician carry malpractice insurance prior to granting admitting privileges. Some of the hospital systems requiring this include, but are not limited to, Barnes-Jewish in Saint Louis, Cox North in Springfield and University Hospital in Columbia.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Family Practice in MissouriThis is just a brief note of appreciation for all of your service in support of my recent application for malpractice insurance. You provided all needed information to make the entire process as “user friendly” as possible, and I appreciate the level of professionalism that you demonstrated.

Best Medical malpractice insurance companies in Missouri.

- Medical Protective

- ProAssurance

- NORCAL

- The Doctors Company

- PSIC

- ISMIE

- Doctors Direct

Why partner with Cunningham Group?

Partnering with Cunningham Group will give you a full view of the Missouri marketplace. We can get you quotes from all the major insurance companies and help you choose the policy that best fits your needs and budget. Our veteran insurance agents average 10+ years of industry experience. Let us help you secure medical malpractice insurance quotes from every major insurance company in Missouri.

Historic Medical Malpractice Insurance Rates in Missouri for Physicians.

Brief History and other important facts of medical malpractice insurance in Missouri.

Though comprehensive reforms to the state’s medical liability system were passed in 2005, portions of these reforms have since been overturned by the Missouri Supreme Court, and the overall effect has not been as profound as reformers had hoped. At the same time, Missouri has many insurers in its marketplace, and, in recent years, rates have been falling.

Tort Reform in Missouri

Missouri has reformed its medical liability system many times. In 1986, the state capped noneconomic damages at $350,000, with built in adjustments for inflation. By 2005, the noneconomic damages cap had ballooned to $579,000. With malpractice rates continuing to rise, the Missouri General Assembly took action in 2005, passing HB 393, which modified 19 sections of the Revised Statutes of Missouri relating to tort damages, with the greatest impact on medical malpractice tort actions.

HB 393 revised the state’s cap on noneconomic damages, making it a “hard cap” of $350,000 and removing the provision to adjust the cap for inflation. Unfortunately for Missouri physicians, this cap was overturned in 2012, with the Missouri Supreme Court declaring it unconstitutional because it violated the right to have a jury determine compensation. Because of this decision, Missouri no longer has a cap on noneconomic damages.

Other provisions of HB 393 are still in place, including restrictions to joint-and-several liability so that a defendant can only be held jointly liable if he or she is found to be more than 51 percent at fault. A defendant found to be less than 51 percent at fault can only be held responsible for damages in proportion to his or her degree of fault. HB 393 also restricted venue shopping, requiring that the trial be located wherever the plaintiff was residing when the injury first occurred.

In 2017, Missouri enacted collateral source reform. Previously, defendant physicians were barred from introducing evidence that part of a plaintiff’s loss was paid for by a party independent of the defendant (e.g., healthcare insurance or public benefits). Under the new reform, the law provides that where the defendant or the defendant’s insurer has paid a portion of the plaintiff’s medical expenses, these sums are not recoverable from the defendant. The new law also relies on the “actual cost” of medical care, rather than “value” of medical care.

Also in 2017, Missouri adopted the more strict Daubert Standard for what expert testimony can be introduced at a medical liability trial.

Resources for Missouri Physicians.

Missouri State Medical Association

Missouri Department of Insurance

Missouri Association of Osteopathic Physicians and Surgeons

Medical Group Management Association of Missouri

MO HealthNet

All MD Missouri Healthcare Defense Attorney Listing

Medical Malpractice Insurance Guide