Start Your Custom Quote Process™

Malpractice Insurance for Doctors & Physicians in Mississippi

Let our specialists compare medical malpractice insurance quotes for your practice in Mississippi

Our partners

Table of Contents

- Medical Liability Claims Trends for Mississippi Healthcare Providers

- How to buy medical malpractice insurance in Mississippi

- How to save money on your malpractice insurance

- How much does medical malpractice insurance cost in Mississippi?

- Medical malpractice requirements in Mississippi

- Find Coverage for your Practice

- Client Testimonials

- Best medical malpractice insurance companies in Mississippi

- Why partner with Cunningham Group in Mississippi?

- Historic medical malpractice insurance rates in Mississippi – since 2000

- History of malpractice insurance in Mississippi

- Resources for Physicians

Mississippi Malpractice Insurance

Mississippi enjoys a stable medical malpractice landscape with comparatively low premiums.

Our 2023 Physician Buyers Guide for purchasing malpractice insurance in Mississippi gives you the information necessary to obtain the strongest, most financially secure policy at the best price. When shopping for coverage, you need a full view of the Mississippi marketplace to find the company that best fits your situation. Choose a broker that can offer multiple quotes from all the major malpractice insurance companies in Mississippi.

Medical Liability Claims Trends for Mississippi Healthcare Providers

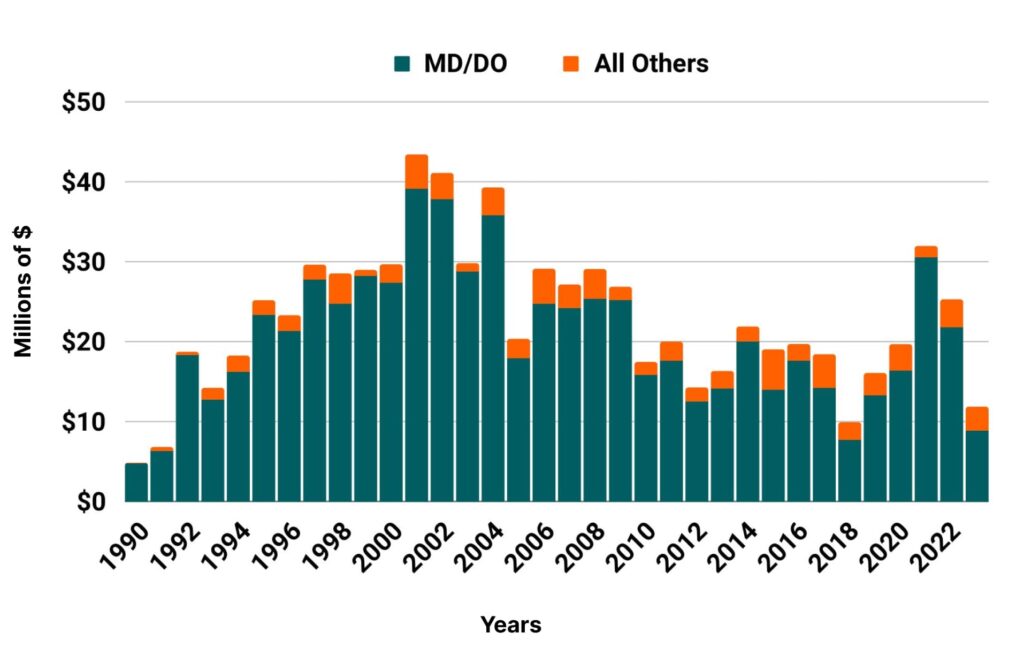

Mississippi NPDB from 1990 to 2023

How to buy malpractice insurance in Mississippi.

The best way to buy malpractice coverage is to work with a reputable malpractice insurance broker in Mississippi who can generate multiple quotes. Your broker will walk you through the lengthy insurance application and underwriting process. Click to get medical malpractice insurance quotes from every major Mississippi malpractice insurance company.

Typically, the malpractice insurance purchasing process goes like this:

- Submit your information for your free medical malpractice insurance quote from every major insurance company in Mississippi.

- One of our veteran malpractice insurance agents who specializes in the Mississippi market will contact you to learn more about your specific needs.

- We shop your coverage to every major insurance company in Mississippi.

- We present you with a number of insurance quotes and give you the information necessary to make an educated and informed decision. Don’t worry. We’re here every step of the way, helping you get the best price with the best company.

- At renewal time, we restart the process of shopping your coverage among every major carrier to keep your policy properly priced.

How to save money on your malpractice insurance.

- The easiest way to save money on your medical malpractice insurance policy is by working with a broker who has the access to generate quotes from every major insurance company, offering an accurate view of the marketplace. As one of the top brokers in Mississippi, we can guide you through the application and underwriting process so you’re confident you secured the best price with the right insurer for your situation.

- The most common limits in Mississippi are $1 million/$3 million. Limits of liability play a major role in determining the overall cost of your policy. Some companies will offer lower limits to save you money. We don’t recommend this. We want your risks fully indemnified so you never have to pay an award out of pocket. Let us save you money by shopping your coverage rather than skimp on protection.

- Check out our 7 secrets your medical malpractice insurance agent won’t tell you page to get insider information on buying coverage in Mississippi.

How much does medical malpractice insurance cost in Mississippi.

Rates for physician malpractice insurance don’t vary much depending on where you practice within the state. Most major insurance companies classify Mississippi as a single territory, which means your specialty’s base rate does not vary depending on your practice address. But you still want multiple quotes to get an accurate view of the marketplace. This is one of the many reasons it’s important to work with an insurance agency that specializes in medical malpractice insurance. Below are mature, base rates with no credits or discounts. We typically get our clients a 30-50% reduction from these rates:

Mississippi

- Internal Medicine Average Rate $2,993

- General Surgeon Average Rate $20,529

- OB/gyn – Average Rate $28,227

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Medical malpractice requirements in Mississippi.

Limits of Liability: The most common limits of liability in Mississippi are $1 million per claim with an annual aggregate cap of $3 million.

Most hospitals require a physician carry malpractice insurance prior to granting admitting privileges. Some of the hospital systems requiring this include, but are not limited to, University of Mississippi Hospital in Jackson, Pascagoula Hospital, and North Mississippi Medical Center in Tupelo.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Surgeon in MississippiTim is so easy to work with. He is very prompt at returning emails/calls. As an office manager and the go between for the doctor and adjuster it is nice to have someone to communicate quickly and easily with. He made renewal a breeze.

Best Medical malpractice insurance companies in Mississippi.

- Medical Protective

- The Doctors Company

- NORCAL

- ProAssurance

- Medical Assurance Company of Mississippi Inc.

Why partner with Cunningham Group?

Partnering with Cunningham Group will give you a full view of the Mississippi marketplace.. Our veteran insurance agents average 10+ years of industry experience. Let us help you secure medical malpractice insurance quotes from every major insurance company in Mississippi.

Historic Medical Malpractice Insurance Rates in Mississippi for Physicians.

Brief History and other important facts of medical malpractice insurance in Mississippi.

Prior to reforms enacted late in 2002, Mississippi had such high malpractice insurance rates that some physicians were retiring early or moving to states with better liability climates, causing a physician shortage in many parts of the state. Rural areas were hit hardest; most cities with a population under 20,000 had no access to an obstetrician and specialists were becoming increasingly scarce. Since passing reforms, the situation has slowly been improving in Mississippi. According to a 2015 report from the Association of American Medical Colleges (AAMC), Mississippi currently has the fewest active physicians per capita of any state, at only 184.7 physicians per 100,000 residents. But, this is a substantial improvement from the AAMC’s 2011 report, which showed only 159.4 active physicians per 100,000 residents in Mississippi.

Tort Reform in Mississippi

During a special session of the state legislature called in late 2002, Mississippi passed a slew of reforms to help ameliorate the problem of high liability rates and resulting physician shortages. The ensuing legislation, House Bill 2 (HB2) included a $500,000 cap on noneconomic damages, required plaintiffs to give defendants 60-days written notice before filing a medical malpractice lawsuit, abolished joint liability for noneconomic damages for defendants found to be less than 30 percent at fault and required plaintiff attorneys to consult with an expert prior to filing a claim. A separate bill passed during the same session, House Bill 19 (HB 19) ended the practice of venue shopping in Mississippi.

In a 2004 special session, Mississippi Governor Haley Barbour ushered a comprehensive civil justice reform bill through the state legislature. House Bill 13 (HB 13) expanded the 2002 medical liability reforms through provisions such as a “hard limit” of $500,000 on noneconomic damages in medical malpractice court cases, removing exceptions for piercing the cap that were part of the original legislation. Additionally, HB13 further tightened the requirements against venue shopping and completely abolished joint liability for all defendants.