Start Your Custom Quote Process™

Medical Malpractice Insurance for Michigan Physicians

Protect Your Career With Comprehensive Coverage Tailored To Your Michigan Practice

Our partners

Table of Contents

- Medical Liability Claims Trends for Michigan Healthcare Providers

- Understanding Michigan’s Liability Limits and Tort Reform

- Do You Need Malpractice Insurance in Michigan?

- How Much Does Malpractice Insurance Cost in Michigan?

- How to Get the Best Coverage at the Right Price

- FAQs About Malpractice Insurance in Michigan

- Get Quotes From All Major Michigan Carriers

- Helpful Resources for Michigan Physicians

Serving Physicians Across Michigan’s Healthcare Landscape

From the academic centers of Ann Arbor to private practices in Grand Rapids and metro Detroit, physicians in Michigan face unique risk profiles shaped by location, specialty, and shifting legal frameworks. Tort reforms have helped stabilize premiums across the state, but rates still vary widely—particularly for high-risk specialties. Whether you’re practicing in Wayne County or Kalamazoo, having malpractice insurance that fits your practice is essential.

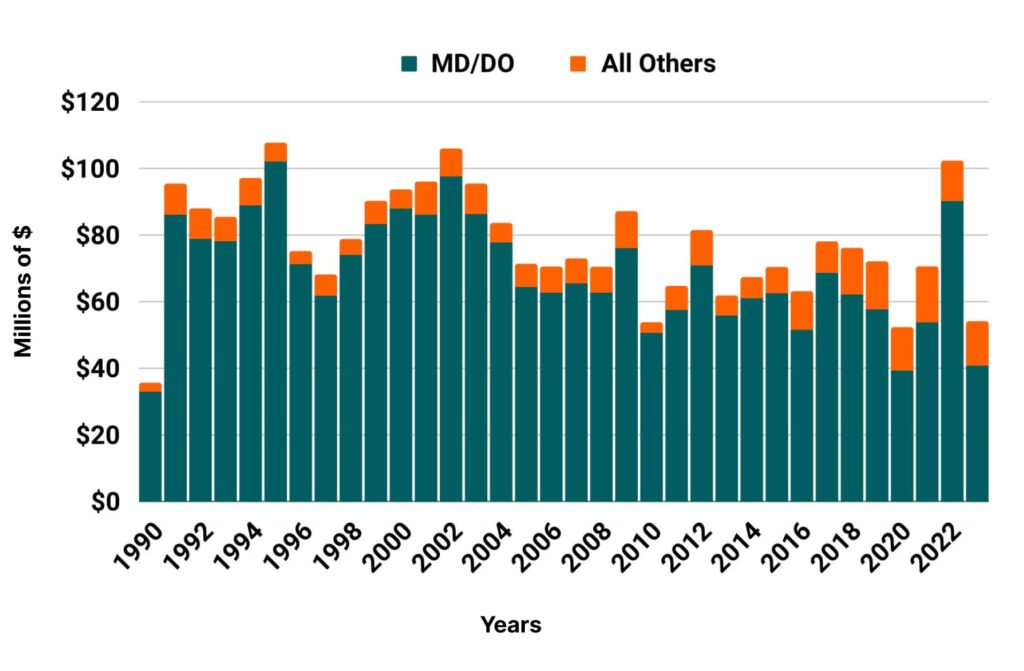

Medical Liability Claims Trends for Michigan Healthcare Providers

Michigan NPDB from 1990 to 2023

Understanding Michigan’s Liability Limits and Tort Reform

Michigan’s most common policy limits are $200,000 per claim with an annual aggregate of $600,000. While this satisfies basic requirements at most hospitals, your specific needs may vary based on the procedures you perform and your patient base.

The state has implemented multiple rounds of tort reform since the 1980s, helping reduce the volume and severity of claims. Today, non-economic damages are capped (adjusted for inflation) and most plaintiffs must submit affidavits of merit. These reforms have helped keep premiums more stable, but it’s still critical to maintain solid coverage.

Do You Need Malpractice Insurance in Michigan?

Michigan does not require physicians to carry malpractice insurance by law. However, most hospitals, clinics, and healthcare systems require proof of coverage for employment, credentialing, or admitting privileges.

For example, major systems like Henry Ford Health, Sparrow Hospital, and University of Michigan Health expect attending and affiliated physicians to carry current liability policies. Even independent physicians often carry coverage for peace of mind and financial security, especially those with claims-made policies who must also consider tail coverage when leaving a role.

Michigan

- Internal Medicine Average Rate $6,727

- General Surgeon Average Rate $27,876

- OB/gyn – Average Rate $30,578

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

How Much Does Malpractice Insurance Cost in Michigan?

Malpractice insurance premiums in Michigan vary based on several factors including:

- Your specialty (e.g., OB/GYNs and surgeons tend to pay higher premiums)

- Your location (e.g., urban areas like Detroit may have higher base rates)

- Your claims history, working hours, and policy type

Medical professionals practicing in Michigan typically find their premiums to be mid-range nationally. We work to secure the best possible pricing based on your needs and current market conditions.

Thanks to our extensive network, we frequently help reduce your final cost by an additional 25–40%. By shopping your coverage across more insurance companies than anyone else, we ensure you receive the lowest possible final price.

Want to see what your policy might cost?

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Oncologist in MichiganI am writing this letter to express my appreciation for the wonderful job that Tim Arnieri did in addressing my need for a short-term insurance policy to cover my elective rotation. Tim went above and beyond to ensure that everything was completed on time and that I got the best price for the insurance that I purchased. I cannot thank him enough.

Plastic Surgeon in MichiganThank you so much for completing this in an amazingly timely and efficient manner. You and your team have done an amazing job in both obtaining the best coverage for the lowest price from an A+ rated company as well as shortening the turnaround time to almost nil. I cannot thank you enough.

How to Get the Best Coverage at the Right Price

When it comes to buying malpractice insurance, working with a broker gives you an unmatched advantage. Unlike captive agents who can only offer one or two options, we shop your coverage across all major carriers in Michigan, maximizing savings and ensuring you find a carrier with the best fit for your specialty, claims profile, and policy preferences.

Our team of veteran brokers simplifies the process by:

- Explaining how policy types like claims-made and occurrence work

- Ensuring your retroactive date is protected during transitions

- Offering unbiased guidance based on your risk and career plans

- Supporting you at renewal with fresh quotes every year

And because broker fees are baked into your premium, you pay the same whether you go direct or through us, so there’s no downside.

Historic Medical Malpractice Insurance Rates in Michigan for Physicians.

FAQs About Malpractice Insurance in Michigan

Do I need malpractice insurance to practice in Michigan?

Not legally, but almost all hospitals and clinics will require proof of coverage.

What type of policy should I get claims-made or occurrence?

Most carriers in Michigan offer claims-made policies. Occurrence policies are less common and typically more expensive upfront.

Does malpractice insurance cover telemedicine in Michigan?

Many policies now include telemedicine coverage, but be sure to confirm multi-state licensing and exposure if you treat out-of-state patients.

What is tail coverage, and do I need it?

Tail coverage protects you from claims filed after your policy ends. If you’re on a claims-made policy and leave a job or retire, tail coverage is crucial.

Get Quotes From All Major Michigan Carriers

We work with:

- Coverys

- Medical Protective

- ProAssurance

- And more

Let us help you secure the right policy with the right carrier.

Helpful Resources for Michigan Physicians

- Michigan State Medical Society

- Medical Malpractice Insurance Guide

- Michigan Department of Insurance and Financial Services

- Michigan Health and Hospital Association

- Michigan Osteopathic Association

- Cunningham’s Medical Malpractice Insurance Guide

- 7 Secrets Your Medical Malpractice Insurance Agent Won’t Tell You