Start Your Custom Quote Process™

Malpractice Insurance for Doctors & Physicians in Georgia

Let our specialists compare medical malpractice insurance quotes for your practice in Georgia

Our partners

Table of Contents

- Medical Liability Claims Trends for Georgia Healthcare Providers

- Is medical malpractice insurance required in Georgia?

- How to buy medical malpractice insurance in Georgia.

- How to save money on your malpractice insurance.

- How much does medical malpractice insurance cost in Georgia?

- Medical malpractice requirements in Georgia.

- Find Coverage for your Practice

- Client Testimonials

- Best medical malpractice insurance companies in Georgia.

- Why partner with Cunningham Group in Georgia?

- Historic medical malpractice insurance rates in Georgia – since 2000.

- History of malpractice insurance in Georgia.

- Resources for Physicians.

Georgia Malpractice Insurance

The market leader in Georgia is MAG Mutual, which currently represents about 40 percent of Georgia premium. But the Georgia malpractice insurance competition has increased in recent years, with new insurers entering the marketplace and opportunities to save premium dollars.

Our Physician Buyers Guide for purchasing malpractice insurance in Georgia gives you the information necessary to obtain the strongest, most financially secure policy at the best price. When shopping for coverage, you need a full view of the Georgia marketplace to find the company that best fits your situation. Choose a broker that can offer multiple quotes from all the major malpractice insurance companies in Georgia.

Medical Liability Claims Trends for Georgia Healthcare Providers

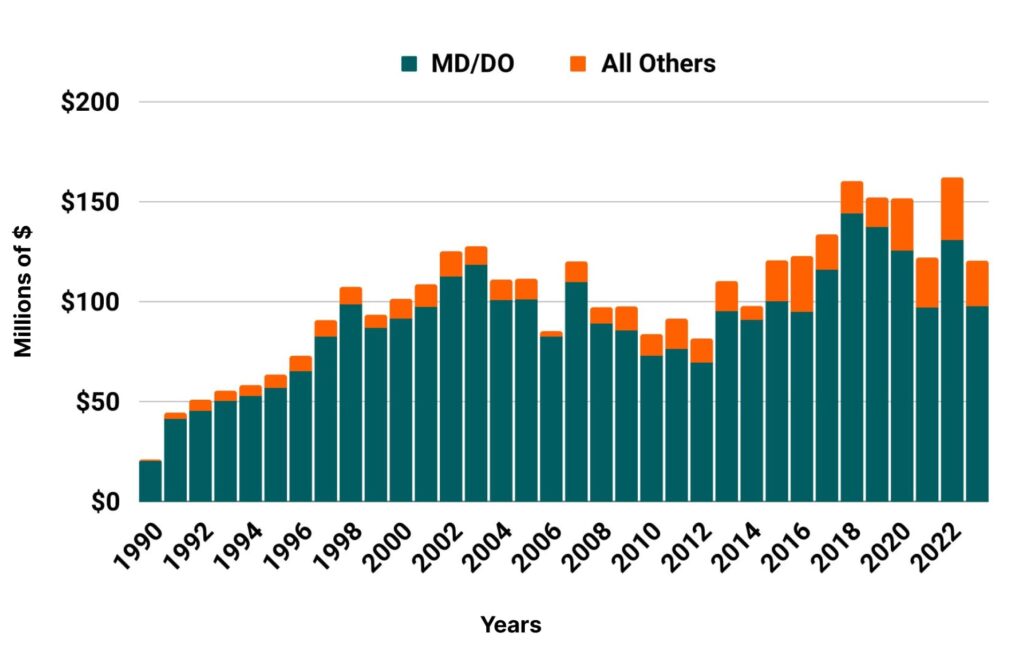

Georgia NPDB from 1990 to 2023

Is medical malpractice insurance required in Georgia?

Yes, medical malpractice insurance is required in Georgia in order to practice medicine in the state. This type of insurance provides financial protection for medical professionals in the case of allegations or claims of medical issues, helping to ensure that they are prepared should they need to deal with unexpected medical expenses or litigation costs.

It’s important to understand your legal and professional responsibilities when it comes to medical malpractice insurance in Georgia. By working with reputable brokers you can find an insurer that offers the best policy and ensure it remains up-to-date to help protect yourself from any unexpected issues should they arise. After all, quality healthcare depends on maintaining a safe and secure environment for both patients and medical professionals alike.

How to buy malpractice insurance in Georgia.

If you’re looking to buy medical malpractice insurance in Georgia, there are a few things to keep in mind. First, it’s important to do your research and compare different policies from different providers. This will help you to find the best coverage at the most competitive rates. In addition, make sure to consider the specific needs of your medical practice, such as the number of patients you see per month and the type of medical procedures you perform.

Most importantly, speak with an experienced malpractice insurance broker who can help guide you through the process, answer any questions that you may have, and generate multiple quotes. Your broker will walk you through the lengthy insurance application and underwriting process.

If you’re ready to learn more today, get medical malpractice insurance quotes from every major Georgia malpractice insurance company.

Typically, the malpractice insurance purchasing process goes like this:

- Submit your information for your free medical malpractice insurance quote from every major insurance company in Georgia.

- One of our veteran malpractice insurance agents who specializes in the Georgia market will contact you to learn more about your specific needs.

- We shop your coverage to every major insurance company in Georgia.

- We present you with a number of insurance quotes and give you the information necessary to make an educated and informed decision. Don’t worry. We’re here every step of the way, helping you get the best price with the best company.

- At renewal time, we restart the process of shopping your coverage among every major carrier to keep your policy properly priced.

By following these tips, you can be sure that you’re buying medical malpractice insurance that is right for your needs and budget.

How to save money on your malpractice insurance.

Ultimately, the key to saving money on medical malpractice insurance is knowing what options are available and being willing to put in a bit of effort upfront in order to reap long-term benefits down the road. With some time and due diligence, it is definitely possible to save money while still getting quality coverage for your medical practice.

- The easiest way to save money on your medical malpractice insurance policy is by working with a broker who has the access to generate quotes from every major insurance company, offering an accurate view of the marketplace. As one of the top brokers in Georgia, we can guide you through the application and underwriting process so you’re confident you secured the best price with the right insurer for your situation.

- The most common limits in Georgia are $1 million/$3 million. Limits of liability play a major role in determining the overall cost of your policy. Some companies will offer lower limits to save you money. We don’t recommend this. We want your risks fully indemnified so you never have to pay an award out of pocket. Let us save you money by shopping for coverage rather than skimp on protection.

- Check out our 7 secrets your medical malpractice insurance agent won’t tell you to get insider information on buying coverage in Georgia.

How much does medical malpractice insurance cost in Georgia?

Rates in Georgia vary slightly dependent on where you practice. For example, a OB/Gyn in Atlanta (Fulton, Dekalb, Gwinnett, Cobb and the other 5 counties that make up Metro Atlanta) could see an annual malpractice premium of $50,000. That same OB/Gyn could move their medical practice to the NW of the state (the south suburbs of Chattanooga on the Georgia side) malpractice premium drop to $25,000. This is one of the many reasons it’s important to work with an insurance agency that specializes in medical malpractice insurance. Below are mature, base rates with no credits or discounts. We typically get our clients a 30-50% reduction from these rates:

Georgia

- Internal Medicine Average Rate $9,653

- General Surgeon Average Rate $31,684

- OB/gyn – Average Rate $44,902

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Medical malpractice requirements in Georgia

Limits of Liability: The most common limits of liability in Georgia are $1 million per claim with an annual aggregate cap of $3 million.

Medical malpractice insurance coverage helps protect medical practitioners against legal liability in the event that they are accused of negligence or error in their medical practice. Medical malpractice insurance not only protects doctors and other healthcare providers, but it also helps to ensure that patients get the care they need without having to worry about quality of treatment.

Most hospitals require a physician to carry malpractice insurance prior to granting admitting privileges. Some of the hospital systems requiring this include, but are not limited to, Augusta University Medical Center, Grady General, Northside Hospital Atlanta, and WellStar Kennestrone.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Family Practice in GeorgiaWorking with David to get my malpractice insurance has been a great experience. He is very attentive to my needs in a policy and responds almost immediately to any questions. As an added bonus he found me a rate with a reputable company that was 1/3 what a local agent quoted me.

Family Practice in GeorgiaIt was great working with David; he made the process simple.

Best Medical malpractice insurance companies in Georgia

- MAG Mutual

- ProAssurance

- NORCAL

- The Doctors Company

- Medical Protective

- ISMIE

Why partner with Cunningham Group?

Partnering with Cunningham Group will give you a full view of the Georgia marketplace. We can get you quotes from all the major insurance companies and help you choose the policy that best fits your needs and budget. Our veteran insurance agents average 10+ years of industry experience. Let us help you secure medical malpractice insurance quotes from every major insurance company in Georgia.

Historic Medical Malpractice Insurance Rates in Georgia for Physicians.

Brief History and other important facts of medical malpractice insurance in Georgia.

Physicians buying malpractice insurance in Georgia have seen conditions improved because of the increased competition entering the state. In part, this may be due to several important tort reforms enacted by the Georgia legislature. Prior to these reforms, Georgia was losing physicians and, in 2002, it was even added to the American Medical Association’s (AMA) list of states in a medical liability crisis. AMA classifies a crisis state as one where—due to rising medical malpractice insurance premiums—specialty physicians are driven to retire, practice elsewhere or curtail certain services.

Since that time, the climate has changed for the better in the Peach State. In response to the crisis, a tort reform package known as Senate Bill 3 were passed in 2005. Though several provisions of Senate Bill 3 have since been struck down by the Georgia Supreme Court, several important provisions remain in place, including an apology law; a requirement to submit an expert affidavit before filing a medical malpractice lawsuit; joint liability reform; periodic payment for damages; and a provision allowing defendants access to plaintiff health information.

Tort Reform in Georgia

Georgia has been moderately successful in enacting tort reforms. As detailed above, Senate Bill 3 implemented significant reforms. However, some of the most essential parts of the law were struck down by the Georgia Supreme Court, including a $350,000 cap on noneconomic damages, which was declared unconstitutional by the Georgia Supreme Court in 2010 because it violated the right to trial by jury. Other parts of SB 3 were also struck down, including a measure to curtail venue shopping.In 2017, Georgia Gov. Nathan Deal signed into law HB 165, a bill that prevents the state’s Medical Practices Act from being used to require Maintenance of Certificate as a condition for the purchase of medical malpractice insurance.