Start Your Custom Quote Process™

Medical Malpractice Insurance for Georgia Doctors

Compare Quotes from Every Major Medical Malpractice Carrier in GA

Our partners

Table of Contents

- Medical Liability Claims Trends for Georgia Healthcare Providers

- Malpractice Insurance Requirements for Georgia Physicians

- Why Malpractice Insurance Still Matters in Georgia

- What Factors Impact Malpractice Insurance Rates in Georgia?

- Client Testimonials

- How to Get the Best Malpractice Coverage in Georgia

- Historic Medical Malpractice Insurance Rates in Georgia for Physicians.

- Frequently Asked Questions: Georgia Medical Malpractice Insurance

- Get a Quote from All Major Georgia Carriers

- Resources for Physicians.

What Georgia Medical Professionals Should Know About Malpractice Coverage

Georgia physicians have seen some major shifts in the malpractice insurance market over the last two decades. Thanks to an influx of new carriers and several rounds of tort reform, coverage options have expanded, and rates have become more competitive in many parts of the state. Still, the legal climate remains active, and navigating the nuances of Georgia’s marketplace requires more than just picking the lowest premium. That’s where the right broker makes a real difference. With region-specific underwriting, a strong regional carrier like MAG Mutual holding a large market share, and differences in risk exposure by specialty and geography, Georgia physicians benefit from working with someone who can shop the full market and guide them toward the best fit.

Medical Liability Claims Trends for Georgia Healthcare Providers

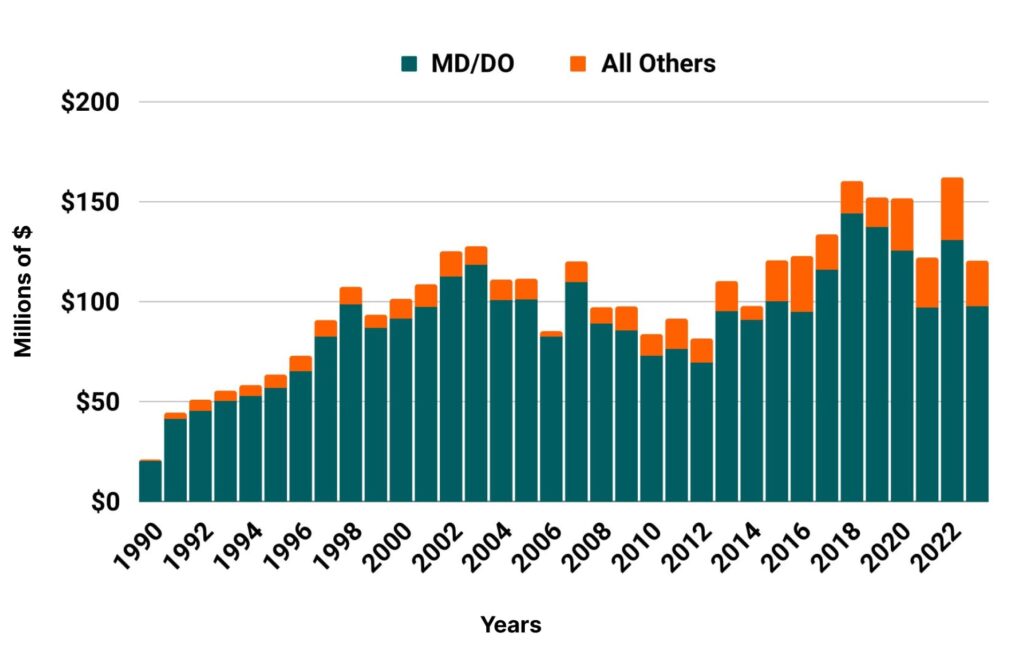

Georgia NPDB from 1990 to 2023

Malpractice Insurance Requirements for Georgia Physicians

Georgia doesn’t have a state law that mandates private practice physicians carry medical malpractice insurance. However, the practical reality is that most physicians must maintain coverage to meet hospital credentialing requirements, secure employment contracts, or satisfy payer network agreements. The most common policy limits are $1 million per claim / $3 million annual aggregate, though some carriers may allow different configurations. Whether you’re practicing independently in Macon or part of a group in metro Atlanta, carrying active coverage is standard professional protocol.

Why Malpractice Insurance Still Matters in Georgia

Even with some tort reform measures in place, Georgia remains one of the most volatile states in the country for large medical liability verdicts. From 2013 to 2022, Georgia recorded 64 nuclear verdicts, awards of $10 million or more, ranking 4th nationally on a per capita basis, with a median award of $24 million. In recent years, high-dollar jury verdicts in dental and medical malpractice cases have escalated, including a $50 million retrial verdict and a $47 million medical liability verdict in 2024 alone.

This legal climate, compounded by aggressive plaintiff strategies like anchoring, phantom damages, and Reptile Theory, continues to drive both higher risk exposure and rising insurance costs for Georgia physicians, especially those in procedural or high-touch specialties. And because the state struck down its $350,000 cap on noneconomic damages in 2010, Georgia providers face uncapped jury awards with little predictability.

That’s why having the right policy isn’t just about preparing for worst-case scenarios. It’s about credentialing, contract stability, and peace of mind in a system where rules can shift due to court rulings and emerging litigation tactics. In high-liability states like Georgia, working with a broker who understands the full market is more than helpful, it’s critical.

*Some data and insights cited from judicialhellholes.org

What Factors Impact Malpractice Insurance Rates in Georgia?

Malpractice premiums in Georgia vary based on a few key elements:

- Your specialty: High-risk specialties like OB/GYN or surgery typically see higher rates.

- Location: Rates can be significantly higher in metro areas like Atlanta compared to rural regions.

- Policy type: Whether you choose a claims-made or occurrence policy affects both current premiums and future tail coverage needs.

- Claims history: A clean record helps, past claims (even closed with no payout) may raise your risk profile.

- Coverage limits: Higher limits mean more protection but also come with a higher cost.

Georgia is one of those states where shopping the market really matters. A physician practicing in North Georgia might pay thousands less in annual premiums than a peer in Atlanta, even for the same specialty. We help you see those pricing differences clearly, then match you with a carrier that balances cost and coverage.

Georgia

- Internal Medicine Average Rate $9,653

- General Surgeon Average Rate $31,684

- OB/gyn – Average Rate $44,902

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Family Practice in GeorgiaWorking with David to get my malpractice insurance has been a great experience. He is very attentive to my needs in a policy and responds almost immediately to any questions. As an added bonus he found me a rate with a reputable company that was 1/3 what a local agent quoted me.

Family Practice in GeorgiaIt was great working with David; he made the process simple.

How to Get the Best Malpractice Coverage in Georgia

Georgia has a competitive carrier environment, including national names like ProAssurance, The Doctors Company, and Medical Protective, alongside regional specialists like MAG Mutual. That gives you options, but not all carriers will be a good match for your practice, risk profile, or budget.

That’s why we:

- Compare quotes across every major insurer in the state

- Break down your policy choices so you’re clear on what you’re getting

- Identify discounts or savings opportunities based on your situation

- Help you avoid common traps like underinsuring to save a few dollars

- Re-shop your policy each year to keep it current and competitive

Our team has worked with Georgia physicians for years and understands how to position your application for the best result. Whether you’re launching a solo practice or renewing group coverage, we’ll help you secure a smart, strategic policy without overpaying.

Historic Medical Malpractice Insurance Rates in Georgia for Physicians.

Frequently Asked Questions: Georgia Medical Malpractice Insurance

Is malpractice insurance required by law in Georgia?

No. However, it’s typically required by hospitals, employers, and health systems, so most practicing physicians do carry it.

What are standard coverage limits in Georgia?

Most policies follow a $1 million per claim / $3 million annual aggregate limit structure. This is widely accepted across hospitals and insurers.

Do rates vary depending on location in Georgia?

Yes. Metro Atlanta often sees higher premiums than other parts of the state due to increased litigation risk.

What happens if I don’t carry malpractice insurance?

While it’s not legally required, going without coverage could cost you hospital privileges, network access, or leave you personally exposed in the event of a claim.

Can I get lower rates by lowering my limits?

Technically, yes, but we don’t recommend it. Instead of cutting protection, we help you find savings by comparing quotes and negotiating on your behalf.

Get a Quote from All Major Georgia Carriers

We work with:

- MAG Mutual

- ProAssurance

- NORCAL

- The Doctors Company

- Medical Protective

- ISMIE

One form. Every top carrier. Your best rate, without the hassle.