Start Your Custom Quote Process™

Medical Malpractice Insurance for Colorado Doctors

Compare Quotes from Every Major Medical Malpractice Carrier in CO

Our partners

Table of Contents

- Medical Liability Claims Trends for Colorado Healthcare Providers

- Why Colorado Physicians Still Need Strong Malpractice Protection

- What Drives Malpractice Premiums in Colorado?

- Malpractice Insurance Requirements in Colorado

- Client Testimonials

- How to Find the Right Malpractice Insurance in Colorado

- Historic medical malpractice insurance rates in Colorado – since 2000.

- Frequently Asked Questions: Colorado Medical Malpractice Insurance

- Get a Quote from All Major Colorado Carriers

- Resources for Physicians.

What Colorado Healthcare Providers Should Know About Malpractice Coverage

Colorado is often considered one of the more stable states when it comes to medical malpractice insurance. Thanks to tort reforms that took root in the late ’80s, insurers in Colorado have had more pricing predictability than in many neighboring states. That’s translated into relatively moderate rates for most specialties and a competitive insurance market with both national and regional carriers.

Still, “stable” doesn’t mean simple. Physicians practicing in Denver, Boulder, or even rural areas of the Western Slope still face risk exposure, and working with the right broker can make a real difference when it comes to coverage, compliance, and cost savings.

Medical Liability Claims Trends for Colorado Healthcare Providers

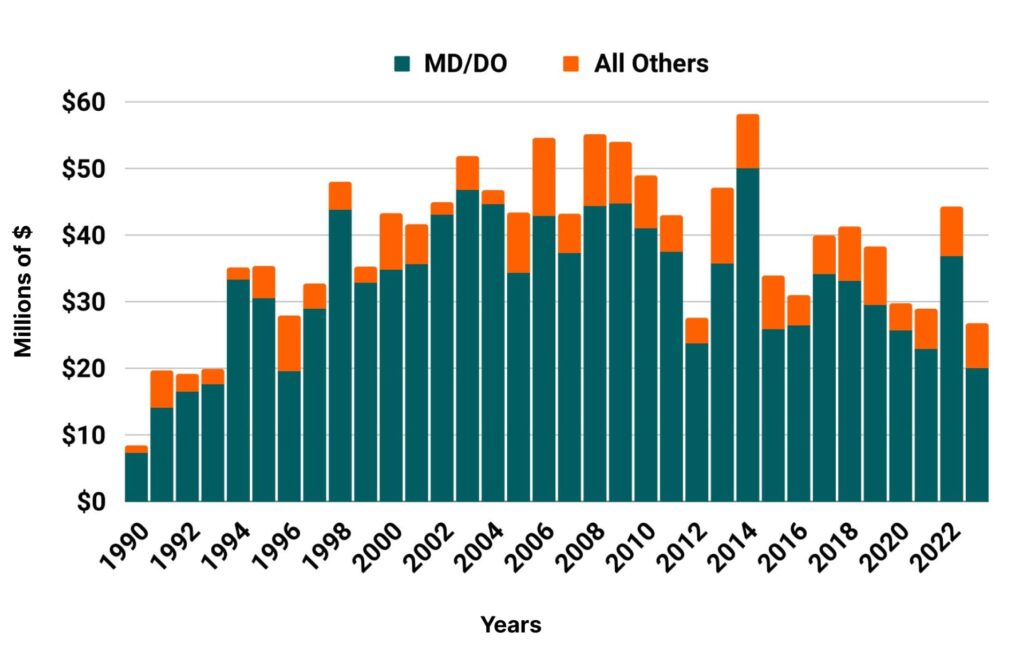

Colorado NPDB from 1990 to 2023

Why Colorado Physicians Still Need Strong Malpractice Protection

Even with tort reform in place, malpractice lawsuits are still very real for Colorado physicians. The state’s legal environment has grown more favorable over the years, but patient expectations, and the cost of defense, remain high.

That’s especially true for high-touch specialties like OB/GYN, surgery, and emergency medicine. And because Colorado uses a modified cap system for noneconomic damages, physicians can still face significant exposure in complex or long-tail cases. Working with a broker who understands how the Health Care Availability Act and subsequent reforms affect your risk, and your policy, is key. We help physicians match their practice needs with the right carrier, so you’re protected without overpaying.

What Drives Malpractice Premiums in Colorado?

While Colorado is generally treated as a single rating area by insurers, a few core factors will still influence your premium:

- Specialty: Risk-heavy specialties typically come with higher base rates.

- Policy type: Claims-made vs. occurrence plays a major role in long-term cost. Claims-made policies require tail coverage; occurrence policies don’t.

- Claims history: A prior suit or settlement, even if resolved, can increase your risk profile.

- Coverage limits: Higher limits may offer more protection but come at a higher cost.

- Practice setting: Independent practices may have different underwriting considerations than hospital-employed physicians.

The best way to navigate these variables is to compare multiple quotes. That’s where we come in. Our team shops the full market and identifies carriers most likely to offer favorable terms based on your risk profile.

Thanks to our extensive access, we routinely help physicians secure 30–50% savings compared to what they might find going directly to a single carrier. And we never recommend cutting coverage just to lower price, we find savings through strategy, not shortcuts.

Colorado

- Internal Medicine Average Rate $8,748

- General Surgeon Average Rate $25,110

- OB/gyn – Average Rate $38,249

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Malpractice Insurance Requirements in Colorado

Colorado doesn’t mandate malpractice insurance by law for independent physicians, but hospitals and health systems almost universally require it for admitting privileges. If you plan to practice at facilities like Presbyterian-St. Luke’s, Denver Health, or Saint Joseph, you’ll need to carry active coverage. Most policies follow a $1 million per claim / $3 million annual aggregate limit structure. That’s considered standard within the state and accepted by nearly all health systems and insurers.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Emergency Medicine in ColoradoI had a great experience with Cunningham Group. They were very responsive and got me a much less expensive rate than their competitors. My sales agent, Tim Arnieri, was very responsive and easy to work with. I would certainly recommend them to other physicians with malpractice insurance needs. Emergency Medicine, DE

Neurologist in ColoradoCunningham Group made the process of obtaining malpractice insurance quick, efficient, and appropriately geared towards my specific endeavors. I am extremely pleased with their service and recommend them to all.

How to Find the Right Malpractice Insurance in Colorado

With multiple carriers writing policies in Colorado, including national names like The Doctors Company, Medical Protective, ProAssurance, and regional leaders like COPIC, physicians have options. But that doesn’t mean the process is straightforward.

We act as your advocate from the quote stage through renewal. That means:

- Handling the application and underwriting process for you

- Explaining the differences between policies and coverage types

- Identifying discounts or risk management credits you might qualify for

- Re-shopping your policy each year to make sure it’s still competitive

Most physicians don’t have the time, or desire, to become insurance experts. That’s our job. And it’s why so many doctors in Colorado turn to us for long-term, tailored malpractice coverage.

Historic Medical Malpractice Insurance Rates in Colorado for Physicians.

Frequently Asked Questions: Colorado Medical Malpractice Insurance

Is malpractice insurance required in Colorado?

Not by law, but almost every hospital requires it for credentialing, and independent practices typically carry it to protect against liability.

What are standard coverage limits?

Most policies in Colorado follow a $1 million per claim / $3 million annual aggregate limit. These are widely accepted across health systems and insurers.

Do malpractice insurance rates vary across Colorado?

Not significantly. Most insurers rate Colorado as a single territory. Still, individual premiums vary based on specialty and risk factors.

How can I save on malpractice insurance without sacrificing coverage?

We shop your coverage across every major carrier in the state, helping you access competitive quotes and additional discounts when available. We don’t cut limits, we find efficiencies.

Will I need tail coverage?

If your policy is claims-made, yes, tail coverage is needed when leaving a job or switching insurers. Occurrence policies don’t require tail but may cost more upfront.

Get a Quote from All Major Colorado Carriers

We work with:

- COPIC

- Medical Protective

- The Doctors Company

- NORCAL

- ProAssurance

Skip the guesswork. Our brokers compare every major carrier so you don’t have to.