Start Your Custom Quote Process™

Medical Malpractice Insurance for South Carolina Physicians

Compare Quotes from Every Major Medical Malpractice Carrier in South Carolina

Our partners

Table of Contents

- Medical Liability Claims Trends for South Carolina Healthcare Providers

- Malpractice Insurance Requirements for South Carolina Physicians

- Why Malpractice Insurance Still Matters in South Carolina

- What Factors Impact Malpractice Insurance Rates in South Carolina?

- Find Coverage for your Practice

- Client Testimonials

- How to Get the Best Malpractice Coverage in South Carolina

- Historic medical malpractice insurance rates in South Carolina – since 2000.

- Frequently Asked Questions: South Carolina Medical Malpractice Insurance

- Resources for Physicians.

What South Carolina Medical Professionals Should Know About Malpractice Coverage

South Carolina’s malpractice insurance market has a mix of long‑standing programs and newer competitive options. Physicians in metro areas like Charleston, Columbia, or Greenville have access to multiple carriers, but risks still vary greatly depending on specialty and claims history. Beneath relatively stable rates, there are legal nuances, such as damage caps and filing requirements, that can significantly affect exposure. Having a policy that matches your practice’s risk profile, from scope of services to workload, is key.

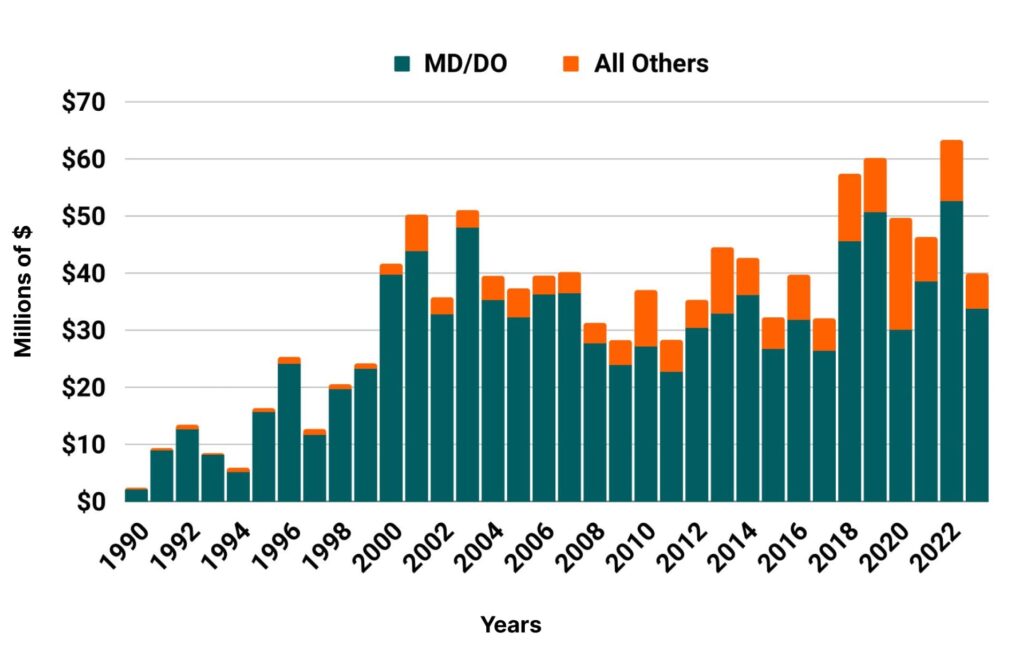

Medical Liability Claims Trends for South Carolina Healthcare Providers

South Carolina NPDB from 1990 to 2023

Malpractice Insurance Requirements for South Carolina Physicians

South Carolina does not require physicians by state statute to carry malpractice insurance. However, in practice, most hospitals, medical groups, and employers do require active coverage to grant privileges or contracts.

Some key legal features to be aware of:

- The South Carolina Medical Malpractice Joint Underwriting Association (JUA) and Patients’ Compensation Fund (PCF) merged into the SC Medical Malpractice Association (SCMMA) as of January 2020, with insurers assessed to cover deficits.

- There is a statutory cap on noneconomic damages (pain and suffering, emotional distress, etc.) of $350,000 per claimant. However economic damages are uncapped.

- Statutes of limitations generally require a claim to be filed within three years from the date of treatment, or from the date when the harm was discovered (with some exceptions, including for minors and discovery of foreign objects).

These rules make it essential for physicians to understand not just policy terms, but also legal deadlines and caps, missing a key requirement can increase risk or exposure.

Why Malpractice Insurance Still Matters in South Carolina

Even with tort reform and statutory caps in place, financial risk remains significant. Average claim indemnity in SC has been rising, and there remains a steady stream of larger payouts in higher‑risk specialties.

Furthermore, procedural requirements, such as needing an affidavit from an expert when initiating claims, and pre‑suit notices, mean that litigation and defense costs can still be substantial even before any award is decided.

For physicians, this means malpractice insurance isn’t just about protecting against worst‑case verdicts, it underpins your ability to maintain hospital privileges, contract with insurers, and protect personal assets in case of a claim. Having robust coverage tailored to your specialty and risk history is a safeguard in a system where legal, procedural, and financial exposure remains real.

What Factors Impact Malpractice Insurance Rates in South Carolina?

Premiums in SC are influenced by a handful of predictable but important factors:

- Specialty Risk: Higher‑risk specialties (e.g. OB/GYN, surgery, anesthesia) typically pay more.

- Policy Type: Whether you choose claims‑made or occurrence coverage; occurrence policies tend to cost more upfront but avoid future tail exposure.

- Claims History: Prior claims or adverse history drive up premiums.

- Coverage Limits: Higher limits = higher protection (but cost more).

- Workload, Practice Setting: High‑case volume or procedural settings increase exposure.

- Geographic Variation: Institutions in suburban/urban areas often have higher premium risk compared to more rural areas.

Because many carriers operate state‑wide, geographic differences are less extreme than in some states, but your personal risk profile and specialty still matter seriously.

| Specialty | Average Annual Premium Range* | Risk Level | Why Rates Are Higher |

| Obstetrics and Gynecology (Major Surgery) | $28,210 – $94,126 | High | Consistently the highest-risk specialty due to high-stakes procedures like labor and delivery. Claims often involve severe, lifelong birth injuries that result in substantial payouts, including significant uncapped economic damages. |

| General Surgery | $16,926 – $46,237 | High | The inherently invasive nature of surgical procedures presents a high risk of complications, including potential errors during surgery, which can lead to severe injury claims and subsequent payouts. |

| Orthopedic Surgery (No Spine) | $16,926 – $49,259 | High | Involves invasive procedures and complex surgeries that carry a significant risk of complications, leading to a higher frequency and severity of claims. |

| Emergency Medicine | $16,926 – $27,250 | High | This specialty operates in a high-pressure, high-stakes environment where rapid decision-making is critical. High patient volume and acuity can increase the potential for misdiagnosis or delayed treatment. |

| Family Practice (No Surgery) | $6,488 – $11,355 | Low | Rates are low due to the non-invasive nature of the practice. Liability is generally associated with a high volume of patient interactions and the potential for a delayed or misdiagnosis of a serious illness. |

| Internal Medicine (No Surgery) | $7,758 – $12,340 | Low | Similar to Family Practice, rates are low, but liability can arise from the potential for misdiagnosis of complex or chronic diseases, which this specialty frequently manages. |

| Pediatrics (No Surgery) | $6,488 – $11,355 | Low | While a low-risk specialty, it faces unique challenges due to the vulnerability of patients. Claims may arise from a delayed diagnosis in children, and the high emotional stakes for families can lead to demands for higher payouts. |

| Psychiatry | $4,513 – $8,824 | Low | The lowest risk category for a physician specialty. Claims are typically related to a failure to prevent self-harm or inappropriate prescribing. The low risk is a result of a non-invasive practice focused on behavioral health. |

*Note: Individual rates can vary based on things like claims history, location, and other factors.

South Carolina

- Internal Medicine Average Rate $4,289

- General Surgeon Average Rate $12,869

- OB/gyn – Average Rate $19,661

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Internist in South CarolinaMr. Leander has been extremely prompt in answering all my questions and has provided excellent customer service. I would definitely recommend his services to my colleagues. He has made the entire process of purchasing medical malpractice insurance quite simple for my practice.

Internist in South CarolinaFast, efficient response time by David to get ALL questions addressed. Stress free relationship with David without compromising quality. Very highly recommend David for your malpractice needs. I feel he has my best interest first without trying to sell me something extra.

How to Get the Best Malpractice Coverage in South Carolina

Here’s what to do to optimize your protection:

- Work with a broker who understands both policy options and state‑level legal requirements (statutes of limitations, caps, etc.).

- Ask for multiple quotes from all major carriers and the SCMMA, especially if you have a higher risk profile or unique practice setup.

- Evaluate whether an occurrence policy might make sense versus a claims‑made one, especially if you’re moving between jobs or expect retirement.

- Build strong documentation and risk management practices (good records, training, patient communication) to make underwriting favorable.

- Review your policy annually to ensure limits, terms, and coverage types still align with your practice’s scope.

Historic Medical Malpractice Insurance Rates in South Carolina for Physicians.

Frequently Asked Questions: South Carolina Medical Malpractice Insurance

Q: Is malpractice insurance required by law in South Carolina?

No , but most hospitals and health systems require active coverage for credentialing and employment.

Q: What are standard policy limits in South Carolina?

While there’s no state‑mandated minimum, many policies adhere to common limits like $1 million per claim / $3 million aggregate; noneconomic damages are capped at $350,000 per claimant.

Q: Are there caps on damages?

Yes , the state limits noneconomic damages at $350,000 per claimant. Economic damages (medical bills, lost wages etc.) are not capped.

Q: What’s the statute of limitations for malpractice claims?

Generally three years from the date of injury, or from when the injury was discovered. There are special rules for minors and foreign objects.

Q: Claims‑made vs. occurrence, what should I choose?

Occurrence policies cost more up front but don’t require tail coverage; claims‑made policies typically cost less initially but require tail coverage when the policy ends or if you switch carriers.

Get a Quote from All Major South Carolina Carriers

We work with:

- Medical Protective

- MAG Mutual Insurance Co.

- The Doctors Company

- NORCAL

- Coverys

- Lonestar

- ProAssurance

One form. Every top carrier. Your best rate, without the hassle.

Resources for South Carolina Physicians

South Carolina Medical Society

Medical Malpractice Insurance Guide

South Carolina Department of Business Regulation

South Carolina Board of Medical Licensure and Discipline

South Carolina Society of Osteopathic Physicians and Surgeons

South Carolina Department of Human Services

All MD South Carolina Healthcare Defense Attorney Listing