Start Your Custom Quote Process™

Malpractice Insurance for Pennsylvania Doctors

Compare Quotes from Every Major Medical Malpractice Carrier in PA

Our partners

Table of Contents

- Medical Liability Claims Trends for Pennsylvania Healthcare Providers

- Quick Overview: Malpractice Insurance Requirements in Pennsylvania

- Why Pennsylvania Physicians Need Malpractice Insurance

- What Impacts Malpractice Insurance Costs in Pennsylvania?

- Client Testimonials

- How to Get the Best Malpractice Insurance in Pennsylvania

- Frequently Asked Questions: Malpractice Insurance in Pennsylvania

- Get a Quote from All Major PA Insurance Carriers

- Helpful Resources for Pennsylvania Physicians

What Medical Professionals in PA Need to Know

Medical malpractice coverage is essential for healthcare providers in Pennsylvania. With high payout trends and unique state-mandated requirements like MCARE participation, securing the right policy is not just a legal obligation—it’s a safeguard for your career, reputation, and peace of mind. At Cunningham Group, our goal is to help physicians and healthcare professionals navigate this complex landscape with confidence.

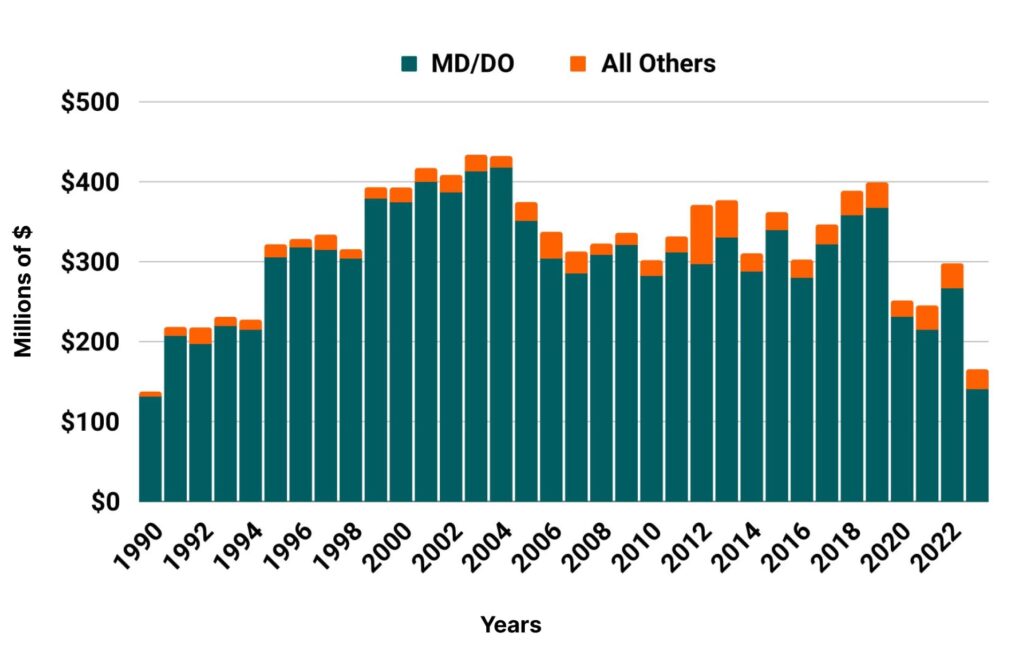

Medical Liability Claims Trends for Pennsylvania Healthcare Providers

Pennsylvania NPDB from 1990 to 2023

Quick Overview: Malpractice Insurance Requirements in Pennsylvania

- Minimum coverage limits: $500,000 per claim / $1.5 million annual aggregate

- Excess coverage: Provided through the MCARE Fund (up to $500,000 per claim)

- Who needs coverage: All practicing physicians and surgeons in the state

- Tail coverage: Often required when ending a claims-made policy unless covered by a new insurer’s prior acts

Why Pennsylvania Physicians Need Malpractice Insurance

If you’re practicing medicine in Pennsylvania, carrying malpractice insurance isn’t just a best practice—it’s required by law. The state mandates participation in the MCARE (Medical Care Availability and Reduction of Error) Fund, which provides excess liability coverage for healthcare providers.

Here’s what you need to know:

- State requirements: Physicians must carry a private malpractice policy with limits of $500,000/$1.5 million. MCARE provides an additional $500,000 per claim in excess coverage.

- Hospital privileges: Most hospitals in the state such as UPMC and others require proof of insurance to grant admitting privileges.

- Tail coverage: If you’re leaving a claims-made policy, securing tail coverage is essential to protect against delayed claims. Our team can help you explore options for nose or tail coverage depending on your transition plans.

What Impacts Malpractice Insurance Costs in Pennsylvania?

OPennsylvania is one of the most expensive states in the country for malpractice insurance—particularly in areas like Philadelphia. However, actual costs vary depending on multiple factors, including:

- Your specialty and risk classification

- Practice location (e.g., urban vs. rural counties)

- Hours worked and scope of services

- Past claims or disciplinary history

- Required limits of liability (e.g., MCARE participation)

Because rates can fluctuate, especially with changes to the MCARE surcharge or carrier pricing, we focus on helping our clients compare options across the market.

Our extensive network allows us to shop your coverage across more insurance companies than anyone else, frequently reducing your final cost by an additional 25–40% and ensuring you receive the lowest possible final price.

Want to see what your policy might cost?

Pennsylvania

- Internal Medicine Average Rate $11,326

- General Surgeon Average Rate $95,637

- OB/gyn – Average Rate $51,320

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

General Surgeon in PennsylvaniaObtaining medical malpractice insurance for the first time was daunting; however Mr. Leander made this experience approachable, easy and streamlined. I would definitely recommend his services to my colleagues or anyone with uncertainties as a first time practicing physician.

Internist in PennsylvaniaI found David very knowledgeable and easy to work with. He made the entire process as painless as possible.

How to Get the Best Malpractice Insurance in Pennsylvania

Pennsylvania’s insurance landscape is complex—especially with MCARE requirements layered on top of private coverage. Here’s how we help physicians find clarity and competitive pricing:

- Compare multiple quotes from every major carrier licensed in the state

- Understand policy differences between claims-made, occurrence, and tail coverage options

- Receive personal guidance from a dedicated agent familiar with Pennsylvania’s legal and insurance climate

Whether you choose to work directly with an insurance provider or use a broker, the agent’s fee is already included in your premium. However, by going direct, you risk overlooking more competitive pricing or better coverage options. We provide a comprehensive view of the market and work to secure the most favorable outcome for you.

Historic Medical Malpractice Insurance Rates in Pennsylvania for Physicians

Frequently Asked Questions: Malpractice Insurance in Pennsylvania

Is malpractice insurance required to practice in Pennsylvania?

Yes, both a private policy and MCARE participation are mandatory for active practitioners.

What is the MCARE Fund?

The MCARE Fund is a state-run excess liability fund that provides additional malpractice coverage above your primary policy limits.

Do I need tail coverage in Pennsylvania?

If you’re leaving a claims-made policy without securing prior acts coverage, yes—tail coverage is necessary to protect against future claims related to past care.

Why are rates so high in Pennsylvania?

High claim payouts, especially in metro areas like Philadelphia, and unique state rules contribute to elevated base rates.

Get a Quote from All Major PA Insurance Carriers

We work with:

- PMSLIC

- Coverys

- Medical Protective

- ProAssurance

- And more

Let us help you secure the right policy with the right carrier.