Start Your Custom Quote Process™

Malpractice Insurance for Doctors & Physicians in Nevada

Let our specialists compare medical malpractice insurance quotes for your practice in Nevada

Our partners

Table of Contents

- Medical Liability Claims Trends for Nevada Healthcare Providers

- How to buy malpractice insurance in Nevada.

- How to save money on your malpractice insurance.

- How much does medical malpractice insurance cost in Nevada?

- Medical malpractice requirements in Nevada.

- Find Coverage for your Practice

- Client Testimonials

- Best medical malpractice insurance companies in Nevada.

- Why partner with Cunningham Group in Nevada?

- Historic medical malpractice insurance rates in Nevada – since 2000.

- History of malpractice insurance in Nevada.

- Resources for Physicians.

Nevada Malpractice Insurance

The Nevada malpractice insurance marketplace has been historically unstable — with a number of carriers entering and exiting the state over the decades.

Our 2023 Physician Buyers Guide for purchasing malpractice insurance in Nevada gives you the information necessary to obtain the strongest, most financially secure policy at the best price. When shopping for coverage, you need a full view of the Nevada marketplace to find the company that best fits your situation. Choose a broker that can offer multiple quotes from all the major malpractice insurance companies in Nevada.

Medical Liability Claims Trends for Nevada Healthcare Providers

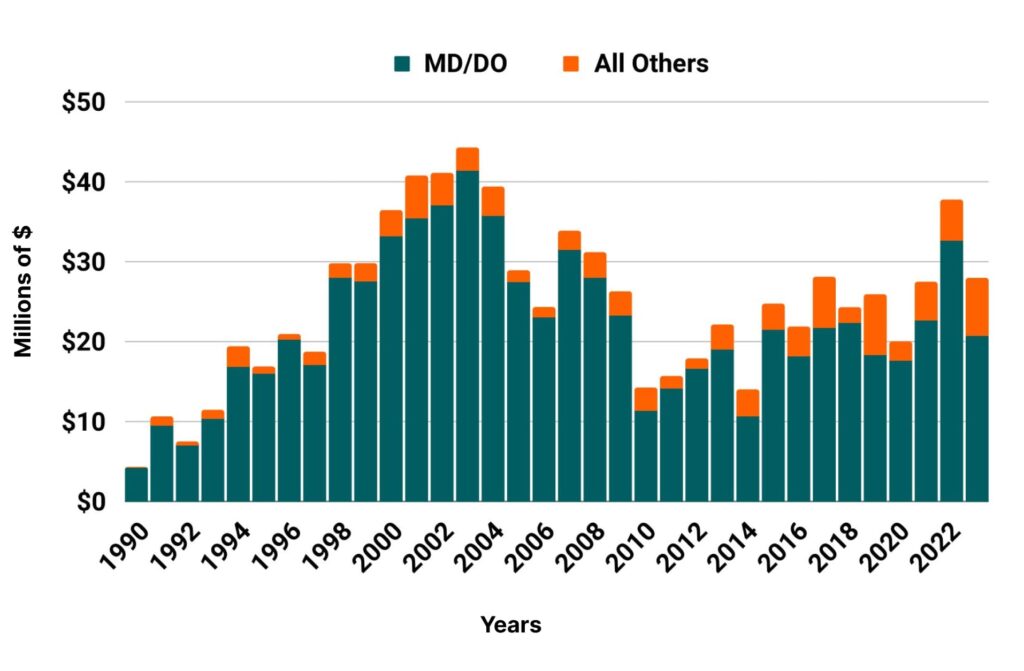

Nevada NPDB from 1990 to 2023

How to buy malpractice insurance in Nevada.

The best way to buy malpractice coverage is to work with a reputable malpractice insurance broker in Nevada who can generate multiple quotes. Your broker will walk you through the lengthy insurance application and underwriting process. for your free medical malpractice insurance quote from every major insurance company in Nevada.

Typically, the malpractice insurance purchasing process goes like this:

- Submit your information.

- One of our veteran malpractice insurance agents who specializes in the Nevada market will contact you to learn more about your specific needs.

- We shop your coverage to every major insurance company in Nevada.

- We present you with a number of insurance quotes and give you the information necessary to make an educated and informed decision. Don’t worry. We’re here every step of the way, helping you get the best price with the best company.

- At renewal time, we restart the process of shopping your coverage among every major carrier to keep your policy properly priced.

How to save money on your malpractice insurance.

- The easiest way to save money on your medical malpractice insurance policy is by working with a broker who has the access to generate quotes from every major insurance company, offering an accurate view of the marketplace. As one of the top brokers in Nevada, we can guide you through the application and underwriting process so you’re confident you secured the best price with the right insurer for your situation.

- The most common limits in Nevada are $1 million/$3 million. Limits of liability play a major role in determining the overall cost of your policy. Some companies will offer lower limits to save you money. We don’t recommend this. We want your risks fully indemnified so you never have to pay an award out of pocket. Let us save you money by shopping your coverage rather than skimp on protection.

- Check out our 7 secrets your medical malpractice insurance agent won’t tell you page to get insider information on buying coverage in Nevada.

How much does medical malpractice insurance cost in Nevada.

Rates in Nevada vary greatly dependent on where you practice. For example, a general surgeon in Las Vegas (Clark County) could see an annual malpractice premium of $25,500. That same general surgeon could move their medical practice to Reno (Washoe County) and see their malpractice premium drop to $12,000. This is one of the many reasons it’s important to work with an insurance agency that specializes in medical malpractice insurance. Below are mature, base rates with no credits or discounts. We typically get our clients a 30-50% reduction from these rates:

Nevada

- Internal Medicine Average Rate $5,957

- General Surgeon Average Rate $21,242

- OB/gyn – Average Rate $30,627

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Medical malpractice requirements in Nevada.

Limits of Liability: The most common limits of liability in Nevada are $1 million per claim with an annual aggregate cap of $3 million.

Most hospitals require a physician carry malpractice insurance prior to granting admitting privileges. Some of the hospital systems requiring this include, but are not limited to, Mountainview Hospital in Las Vegas, Renown South Meadows in Reno and Henderson Hospital.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Family Practice in NevadaI called Tim at Cunningham Group; he worked fast and furiously to get my colleague insured in record time. There is absolutely no way a large broker could have acted so nimbly and kindly. I am going to have Tim check on quotes for my other practice. I highly recommend the Cunningham Group.

Orthopedic Surgeon in NevadaAfter 23 years in Medicine I appreciate you and the Cunningham Group. You found me a policy tailored to my needs and at an excellent premium. Your ability to fully explain my options and obtain the best policy rates, all in a timely fashion, is truly appreciated.

Best Medical malpractice insurance companies in Nevada.

- Medical Protective

- The Doctors Company

- NORCAL

- ProAssurance

- Nevada Mutual

Why partner with Cunningham Group?

Partnering with Cunningham Group will give you a full view of the Nevada marketplace. We can get you quotes from all the major insurance companies and help you choose the policy that best fits your needs and budget. Our company was founded in Nevada, and this is where our headquarters is located. We know Nevada better than any broker in the state. Our veteran insurance agents average 15+ years of industry experience. Let us help you secure medical malpractice insurance quotes from every major insurance company in Nevada.

Historic Medical Malpractice Insurance Rates in Nevada for Physicians.

Brief History and other important facts of medical malpractice insurance in Nevada.

Prior to tort reforms being passed in 2002, Nevada physicians were facing skyrocketing premiums and many were leaving the state. This situation led to a 2002 tort reform bill, which capped noneconomic damages at $350,000. However, it allowed for exceptions for gross negligence and exceptional circumstances, which physicians argued nullified any impact on rising medical malpractice insurance rates. The issue was ultimately decided in favor of the physicians when voters approved the 2004 “Keep Our Doctors in Nevada” ballot initiative, which rescinded any exceptions to the noneconomic damages cap and added further barriers to filing frivolous lawsuits.

Tort Reform in Nevada

The noneconomic damage cap and subsequent ballot initiative have helped to stabilize medical malpractice rates in the Silver State. Other important measures include joint and several liability reform, collateral source reform, limits on attorney fees and the use of periodic payments. Nevada has faced several challenges to its noneconomic damage cap. Most recently, the Nevada Supreme Court upheld the cap, overturning an earlier ruling that it was unconstitutional.

Resources for Nevada Physicians.

Nevada State Medical Association

Nevada Division of Insurance

Nevada State Board of Medical Examiners

Nevada Osteopathic Medical Association

Nevada Medical Group Management Association

Nevada Medicaid and Nevada CheckUp

All MD Nevada Healthcare Defense Attorney Listing

Medical Malpractice Insurance Guide