Start Your Custom Quote Process™

Malpractice Insurance for Medical Professionals in Illinois

Compare quotes, understand coverage, and protect your career with expert help.

Our partners

Table of Contents

- Medical Liability Claims Trends for Illinois Healthcare Providers

- Who’s Practicing in Illinois: From Cook County to Downstate

- Do You Need Malpractice Insurance in Illinois?

- How Much Does Malpractice Insurance Cost in Illinois?

- How to Get the Best Coverage at the Right Price

- Medical malpractice requirements in Illinois.

- Client Testimonials

- Historic Medical Malpractice Insurance Rates in Illinois for Physicians.

- FAQs About Malpractice Insurance in Illinois

- Get a Quote from All Major Illinois Carriers

- Additional Resources for Illinois Doctors and Physicians

What Illinois Physicians Need to Know

Illinois has one of the most complex—and costly—malpractice environments in the U.S. Whether you’re practicing in Chicago or a rural part of the state, having the right malpractice coverage isn’t just smart, it’s often required. Rates vary by specialty, and the legal climate can make even experienced providers vulnerable to claims. That’s why physicians and advanced practitioners across the state rely on experts to help them find comprehensive, competitively priced malpractice insurance.

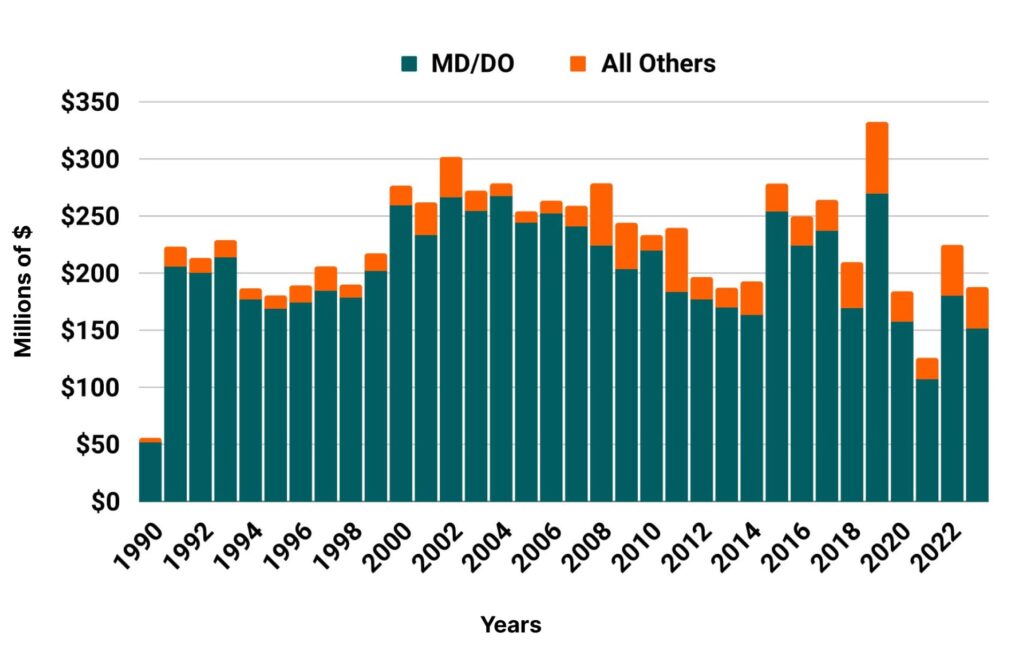

Medical Liability Claims Trends for Illinois Healthcare Providers

Illinois NPDB from 1990 to 2023

Who’s Practicing in Illinois: From Cook County to Downstate

Illinois is home to some of the most respected medical institutions in the country—including Northwestern, Rush, University of Chicago, and Advocate Health. With major hospitals concentrated in Cook County and a broad mix of urban and rural practices downstate, the state attracts a wide range of specialties:

- General practitioners and internal medicine providers

- Surgeons, OBGYNs, and other high-liability specialties

- Nurse Practitioners and Physician Assistants

- Telehealth and hybrid-care clinicians

- Medical directors

While opportunities vary, one thing remains consistent: practicing without proper malpractice coverage puts your license, finances, and reputation at serious risk.

Do You Need Malpractice Insurance in Illinois?

In short: yes. Illinois doesn’t require all doctors to carry malpractice insurance by law, but most hospitals and employers do. For example:

- Major hospital systems like Advocate, AMITA, and Northwestern typically require proof of active malpractice coverage before granting admitting privileges.

- Physicians working independently, switching jobs, or retiring need to consider tail coverage—which protects you from claims filed after your policy ends.

Even if your employer provides some coverage, it may not follow you if you moonlight, transition roles, or change states. A qualified broker can help you understand whether supplemental or standalone coverage makes sense for your specific situation.

How Much Does Malpractice Insurance Cost in Illinois?

Malpractice premiums in Illinois are higher than in many other states, driven by the state’s legal environment and history of large payouts.

These rates can vary widely, especially by specialty and location. We help you get the most out of your options by quoting your coverage with every major insurer in the state, often saving our clients 25–40% compared to going direct or using limited-access agents.

Want to see what your policy might cost?

How to Get the Best Coverage at the Right Price

Not all malpractice insurance is created equal. Here’s how to make sure you’re protected and getting the best value:

- Compare multiple carriers. Rates and coverage terms vary by insurer—especially when it comes to tail coverage, limits, and exclusions.

- Work with a broker, not just a single company. A broker like Cunningham Group can shop all the top carriers and explain the differences clearly.

- Avoid shortcuts. Choosing lower limits may save money short-term, but could leave you exposed in a high-payout state like Illinois.

- Ask about discounts. New-to-practice, no-claims history, and risk management course completion can all lower your premium.

Pro tip: You’ll get the same quote from a carrier whether you go direct or work with a broker. But brokers give you options—and advocacy.

Illinois

- Internal Medicine Average Rate $12,175

- General Surgeon Average Rate $37,455

- OB/gyn – Average Rate $54,307

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Medical malpractice requirements in Illinois.

Limits of Liability: The most common limits of liability in Illinois are $1 million per claim with an annual aggregate cap of $3 million.

Most hospitals require a physician carry malpractice insurance prior to granting admitting privileges. Some of the hospital systems requiring this include, but are not limited to, Advocate, AMITA and Northwestern.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Internist in IllinoisDavid Leander was recommended to me by a colleague who has been working with David for the last 5 years. David was just awesome in explaining everything and helping me lower the cost I was paying.

Medical Director in IllinoisTim was pleasant, quick to respond and went out of his way to come up with an insurance plan that fit my needs. He was kind enough to speak with my employer’s lawyers to make sure that I have the exact coverage that is needed. In short, my experience with Tim has been excellent.

Historic Medical Malpractice Insurance Rates in Illinois for Physicians.

FAQs About Malpractice Insurance in Illinois

Do I need my own policy if I’m employed by a hospital?

Maybe. Some employer-provided policies don’t cover moonlighting, gaps, or tail needs when you leave. It’s worth reviewing your contract.

Are malpractice premiums higher in Chicago?

Historically, yes, so location matters.

What limits of liability should I carry?

The standard is $1M per claim / $3M aggregate. Hospitals typically require these minimums, and we don’t recommend going lower.

Can I save money without sacrificing protection?

Absolutely. Many of our clients save up to 50% just by comparing quotes across top-rated insurers in the state.

Get a Quote from All Major Illinois Carriers

Cunningham Group is based in Illinois and has decades of experience helping physicians across the state find the right coverage. We work with every major malpractice insurance provider, including:

- ISMIE

- Medical Protective

- The Doctors Company

- NORCAL Group

- Coverys

Let us help you compare options, understand coverage terms, and secure the best price. Quotes are fast, free, and customized to your specialty.