Start Your Custom Quote Process™

Malpractice Insurance for Florida Physicians in 2025

Compare quotes, understand Florida's liability laws, and secure the right coverage for your practice.

Our partners

Table of Contents

- Medical Liability Claims Trends for Florida Healthcare Providers

- Who’s Practicing in Florida: High Volume, High Risk, and a Lot of Variation

- Do You Need Malpractice Insurance in Florida?

- How Much Does Malpractice Insurance Cost in Florida?

- Client Testimonials

- How to Get the Best Coverage at the Right Price

- FAQs About Malpractice Insurance in Florida

- All Major Florida Malpractice Carriers

- Resources for Florida Physicians

What Florida Physicians Need to Know

Florida is known for its high-volume litigation environment and some of the highest malpractice insurance premiums in the country, especially for high-risk specialties. With an active tort reform history, strict state requirements, and varied regional risk levels, physicians in Florida must understand what type of coverage they need and how to shop smart. Whether practicing in Miami, Orlando, Tampa, or a rural county, the right policy can protect your career and peace of mind.

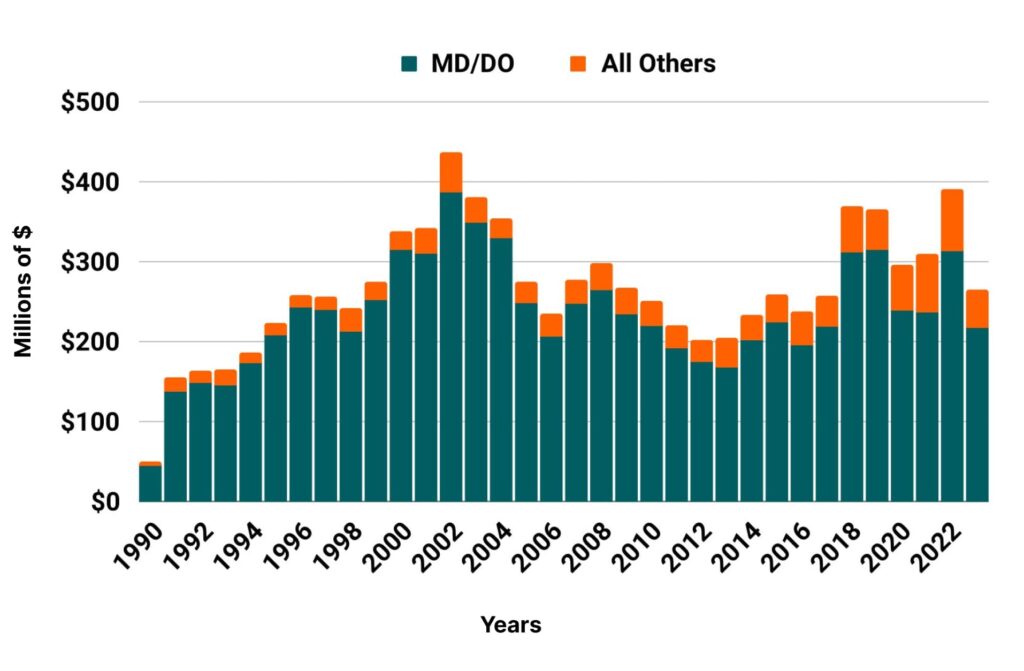

Medical Liability Claims Trends for Florida Healthcare Providers

Florida NPDB from 1990 to 2023

Who’s Practicing in Florida: High Volume, High Risk, and a Lot of Variation

Florida’s physician population includes everyone from hospital-employed specialists to independent concierge providers and telehealth practitioners. The most common coverage needs come from:

- Surgeons, anesthesiologists, and OBGYNs

- Primary care doctors and internal medicine specialists

- Nurse Practitioners, PAs, and urgent care providers

- Medical directors, locum tenens, and moonlighters

- Multistate telemedicine professionals licensed in Florida

Because Florida is a frequent site of malpractice lawsuits, even low-risk specialties face greater liability exposure than in many other states.

Do You Need Malpractice Insurance in Florida?

Yes, Florida has unique legal and hospital requirements when it comes to malpractice insurance. While the state does not mandate that all physicians carry malpractice coverage, those who choose to “go bare” must comply with Florida Statute 458.320 and meet strict financial responsibility standards and comply with state disclosure rules.

Here’s what that means in practice:

- Physicians not carrying malpractice insurance must either post a letter of credit, escrow account, or bond of $100,000 per claim / $300,000 aggregate, and must notify patients of their uninsured status using signage and consent disclosures.

- Most hospitals, medical groups, and employers require active malpractice insurance to grant privileges or employment.

- If you’re on a claims-made policy, you’ll need tail coverage when you retire, switch jobs, or leave a policy—especially since Florida allows claims to be filed years after care is delivered.

Please Note: Florida’s “going bare” rules are nuanced and come with reputational and legal risks. Always consult with a trusted malpractice insurance broker to ensure you’re meeting the right requirements for your specialty, employer, and practice setting.

We typically get our clients a 30-50% reduction from these rates:

Florida

- Internal Medicine Average Rate $15,436

- General Surgeon Average Rate $49,942

- OB/gyn – Average Rate $66,373

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

How Much Does Malpractice Insurance Cost in Florida?

Florida physicians face some of the highest average premiums in the nation, particularly for OBGYNs and surgeons. Factors that influence your rate include your specialty, location, and claims history.

Our team works with more malpractice insurance providers than any other broker in Florida. That wide access means we can often secure you savings of 25–40% by comparing quotes across the full marketplace—not just a select few options.

Premiums in Dade, Broward, and Palm Beach counties are especially high due to legal risk concentration.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Plastic Surgeon in FloridaThe professional and prompt service I received from Cunningham Group was excellent and allowed me to select a better policy at a reduced rate. I highly recommend contacting them before a next purchase or renewal. My experience was well worth it.

Internist in FloridaTim was the most helpful, patient and knowledge agent that I have ever encountered. It has been a pleasure working with him. I will recommend him to my colleagues without reservation.

How to Get the Best Coverage at the Right Price

Shopping for malpractice insurance in Florida can be overwhelming—especially given how much rates and terms vary between carriers.

Here’s how to get the best value:

- Work with a broker who specializes in the Florida market. We understand the state’s legal nuances and carrier landscape.

- Get quotes from all major insurers. Don’t rely on a single company or agent—get a full view of the options available to you.

- Don’t go uninsured. Even though Florida doesn’t mandate coverage, the risks of practicing without it are too great for most providers.

- Evaluate tail coverage needs. Many policies are claims-made, meaning you’ll need tail protection when you retire, move, or switch employers.

Remember: Working with a broker doesn’t cost extra. The agent’s fee is already baked into the premium, so whether you go direct to an insurance company or use a broker, you’ll pay the same price. The difference? Going direct means you don’t get the full view of the marketplace and you might miss out on better pricing or a policy that’s a better fit for your needs.

Historic Medical Malpractice Insurance Rates in Florida for Physicians.

FAQs About Malpractice Insurance in Florida

Is malpractice insurance required in Florida?

Not technically—but if you don’t carry coverage, you must post a bond or escrowed funds. Most hospitals require proof of insurance regardless of the law.

Why are malpractice rates so high in Florida?

Florida’s history of large jury awards, frequent lawsuits, and inconsistent tort reform contributes to elevated premiums—especially in high-risk counties.

Can I get part-time or moonlighting coverage in Florida?

Yes, we regularly help doctors get flexible coverage for part-time roles, locum tenens, or secondary clinical positions.

What are Florida’s typical limits of liability?

The most common limits are $250,000 per claim / $750,000 aggregate, though higher limits may be required by hospitals or employers.

Get a Malpractice Quote from All Major Florida Carriers

Cunningham Group works with every top-rated malpractice insurance provider offering coverage in Florida, including:

- The Doctors Company

- Medical Protective

- NORCAL Group

- MedPro Group

- Aspen / ProAssurance

We’ll help you compare policies, clarify tail coverage needs, and lock in the best available malpractice rates for your specialty and location.