Start Your Custom Quote Process™

Medical Malpractice Insurance for New York Physicians

Compare Quotes from Every Major Medical Malpractice Carrier in New York

Our partners

Table of Contents

- Medical Liability Claims Trends for New York Healthcare Providers

- Is Malpractice Insurance Required in New York?

- Why Physicians in New York Need Malpractice Insurance

- What Drives Malpractice Insurance Rates in New York?

- Client Testimonials

- How to Find the Best Malpractice Coverage in New York

- Frequently Asked Questions: Medical Malpractice Insurance in New York

- Get a Quote from All Major New York Carriers

- Resources for New York Physicians

What New York Medical Professionals Should Know About Malpractice Coverage

Practicing medicine in New York comes with high professional standards, and high legal exposure. Whether you’re in private practice in Westchester or on staff at a major NYC hospital, malpractice claims are a daily risk. While New York doesn’t mandate coverage by law, most hospital systems (like Mount Sinai and Montefiore) require physicians to carry medical malpractice insurance to maintain privileges. And given the state’s history of large payouts and complex regulations, going without coverage just isn’t an option

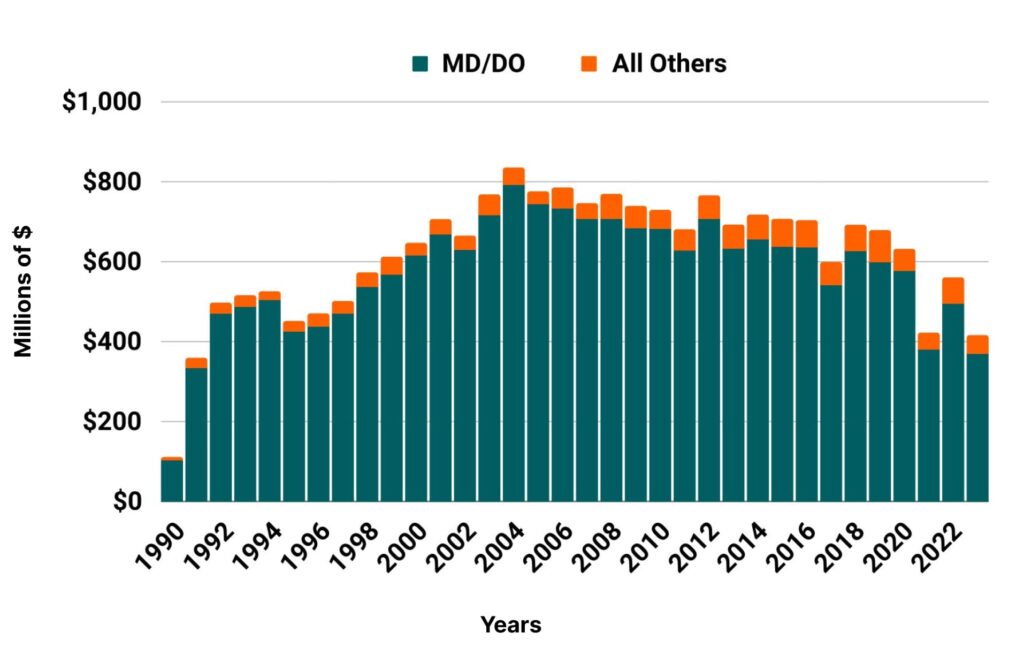

Medical Liability Claims Trends for New York Healthcare Providers

New York NPDB from 1990 to 2023

Is Malpractice Insurance Required in New York?

Technically, no. The state of New York does not legally require physicians to carry malpractice insurance. But in practice, most healthcare facilities, including top hospitals like NYU Langone, Upstate Medical, and NewYork-Presbyterian, require active coverage as a condition for employment or admitting privileges.The standard limits of liability in New York are $1.3 million per claim / $3.9 million aggregate per year, though some physicians opt for higher limits depending on specialty or contractual obligations.

Why Physicians in New York Need Malpractice Insurance

New York is consistently one of the most litigious states when it comes to medical malpractice. In fact, the state led the nation in total malpractice payouts in 2024, with more than $550 million in claims.

What’s more, the majority of New York malpractice cases are settled before trial, yet defense costs and settlement amounts have surged. Between rising legal fees, longer case durations, and the increasing frequency of “nuclear verdicts” (jury awards over $10 million), having comprehensive coverage isn’t just a precaution, it’s protection for your license, livelihood, and reputation.

What Drives Malpractice Insurance Rates in New York?

Rates in New York are among the highest in the nation, and they vary drastically by county. For example, a general surgeon in Manhattan may pay over double the premium of a peer practicing upstate.

Here’s what influences how much you’ll pay:

- Practice location: Rates are zip-code specific. NYC-area physicians pay the most.

- Specialty: Higher-risk fields like OB/GYN or surgery command higher premiums.

- Policy type: Occurrence policies (common in NY) are pricier but don’t require tail coverage.

- Claims history: Past malpractice claims will raise your premium.

- Coverage limits: Higher limits = higher cost.

- Hours worked: Full-time practice usually means higher exposure, and higher premiums.

It’s also worth noting that insurance defense costs are climbing, and 68% of medical groups nationwide reported premium hikes in the last year, with an average increase of 11%.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Plastic Surgeon in New YorkCunningham Group worked diligently to find me the best medical malpractice insurance policy to meet my practice’s needs. I would highly recommend their services to my colleagues.

How to Find the Best Malpractice Coverage in New York

New York has one of the most complex medical liability insurance markets in the country. The state has only a few admitted carriers (like MLMIC, PRI, and The Doctors Company), along with a mix of risk retention groups and non-admitted insurers. Shopping effectively means understanding how these companies differ in coverage terms, financial stability, and appetite for specific specialties.

Thanks to our extensive network, we frequently help reduce your final cost by an additional 25–40%. By shopping your coverage across more insurance companies than anyone else, we ensure you receive the lowest possible price, without compromising coverage.

We also help physicians understand which policy type fits best (claims-made vs. occurrence), when to consider tail coverage, and how to position yourself for better renewal pricing.

New York

- Internal Medicine Average Rate $5,220

- General Surgeon Average Rate $22,541

- OB/gyn – Average Rate $28,212

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Frequently Asked Questions: Medical Malpractice Insurance in New York

Is malpractice insurance mandatory in New York?

Not by law, but most hospitals and employers require it. Going without coverage leaves you personally liable in the event of a claim.

Why are New York rates so high?

Large settlements, frequent litigation, and limited tort reform all contribute. The state also has a long-standing pattern of high jury awards.

Do I need tail coverage in New York?

Only if you have a claims-made policy and switch carriers or retire. Many physicians opt for occurrence policies, which don’t require tail, though they typically cost more upfront.

Which companies offer malpractice insurance in New York?

Major players include MLMIC, PRI (EmPRO), The Doctors Company, MedPro RRG, and others. Not all carriers write in every specialty, so it’s important to work with a broker who knows the full market.

Can I get discounts?

Yes, especially if you’re new to practice, part of a group, or have no claims history. Our brokers help identify available credits and risk reduction strategies that can lower your cost.

Get a Quote from All Major New York Carriers

We work with:

- Medical Liability Mutual Insurance Company (MLMIC)

- Physician’s Reciprocal Insurance (PRI)

- Hospitals Insurance Co.

- MedPro RRG

- The Doctors Company

Every carrier. Every angle. We’ll help you find the smartest policy for your situation.

Resources for New York Physicians

Medical Society of the State of New York

Medical Malpractice Insurance Guide

New York State Department of Financial Services

Office of the Professions – New York State Education

New York State Osteopathic Medical Society

All MD New York Healthcare Defense Attorney Listing