Start Your Custom Quote Process™

Malpractice Insurance for California Medical Professionals

Compare top carriers, understand MICRA updates, and protect your practice.

Our partners

Table of contents

- Medical Liability Claims Trends for California Healthcare Providers

- Who’s Practicing in California: Diverse Roles, Complex Risks

- Do You Need Malpractice Insurance in California?

- How Much Does Malpractice Insurance Cost in California?

- How to Get the Best Coverage at the Right Price

- Client Testimonials

- Historic Medical Malpractice Insurance Rates in California for Physicians.

- FAQs About Malpractice Insurance in California

- Get a Quote from All Major California Carriers

- Additional Resources for California Physicians

What California Physicians Need to Know

California’s malpractice insurance landscape is shaped by a long history of tort reform, led by the landmark MICRA legislation. While this keeps premium costs relatively moderate compared to other high-risk states, recent updates to MICRA laws are changing how much you may be liable for. Whether you’re working in a major health system or starting a private practice, having the right malpractice coverage remains essential.

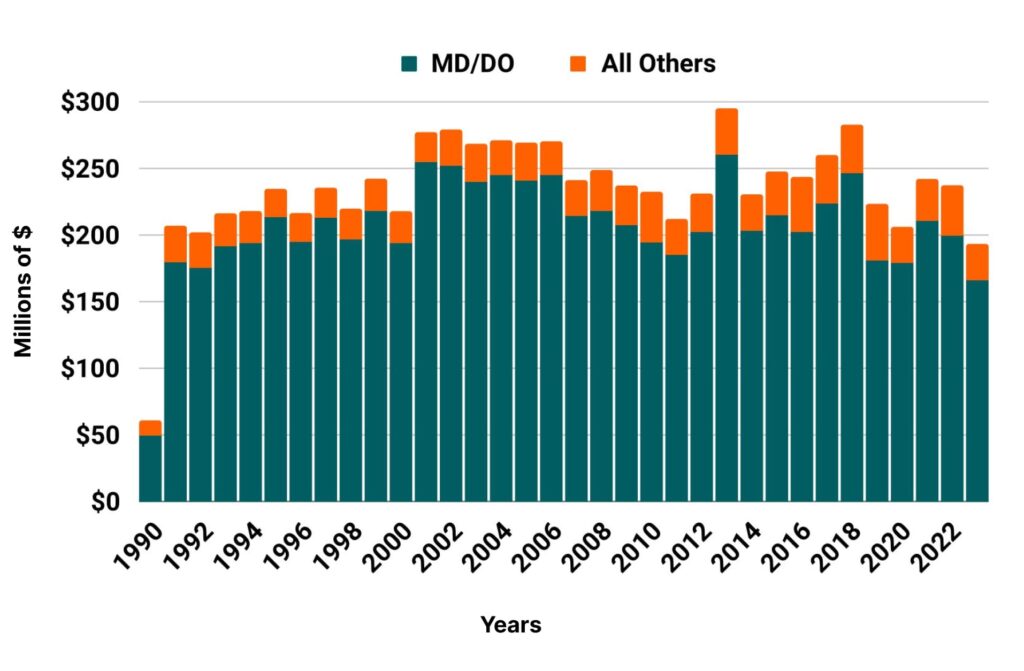

Medical Liability Claims Trends for California Healthcare Providers

California NPDB from 1990 to 2023

Who’s Practicing in California: Diverse Roles, Complex Risks

From Los Angeles to Sacramento, California’s healthcare system spans a huge range of specialties and employment types. The state is home to:

- Surgeons, anesthesiologists, and hospital-based physicians

- Primary care doctors and concierge providers

- Nurse Practitioners and Physician Assistants in independent roles

- Telemedicine practitioners licensed in multiple states

- Medical directors and group practice owners

California also has a large number of physicians working part-time, in nonclinical or hybrid care roles—each with unique liability concerns.

Do You Need Malpractice Insurance in California?

While California doesn’t legally require all physicians to carry malpractice insurance, most hospitals and medical groups do. In fact, coverage is often required to:

- Obtain hospital admitting privileges

- Participate in group practice agreements

- Satisfy employment contracts or managed care requirements

Tail coverage is also a major consideration—especially for physicians working under claims-made policies. If you plan to change jobs, retire, or leave the state, you may need extended reporting coverage to avoid liability for prior care.

How Much Does Malpractice Insurance Cost in California?

Thanks to California’s longstanding tort reform laws, base malpractice premiums in the state are generally lower than in states like Florida or Illinois. However, costs vary widely based on specialty and location.

By partnering with all major malpractice insurance carriers in California, we give you access to more quotes—and often unlock savings of 25–40% beyond standard rates. It’s our broad reach that helps us consistently deliver the best price for your coverage.

Note: Rates are typically higher in urban markets like Los Angeles and San Francisco. Physicians in lower-risk specialties or rural regions may see significantly reduced costs.

Want to see your personalized rate from multiple carriers?

Request your free quote now »

California

- Internal Medicine Average Rate $8,784

- General Surgeon Average Rate $15,284

- OB/gyn – Average Rate $14,616

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

How to Get the Best Coverage at the Right Price

With California’s evolving liability laws and carrier differences, here’s how to shop smart:

- Compare policies from all top-rated carriers. Prices, terms, and tail requirements vary—especially with MICRA reforms now in effect.

- Choose the right policy type. Many California doctors use claims-made policies, which are cheaper up front but may require expensive tail coverage later.

- Work with a broker who knows California law. A malpractice specialist like Cunningham can explain how MICRA updates affect your exposure.

- Ask about discounts. Many insurers offer savings for new doctors, clean claims histories, or risk management course completion.

Brokers don’t cost extra—our commission is built into the premium, so you get the same price as going direct, with added guidance and advocacy.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

OB in CaliforniaTim Arnieri at the Cunningham Group was recommended to me by a colleague who has been with the Group for years. Tim was pleasant, quick to respond and went out of his way to come up with an insurance plan that fit my needs. He was kind enough to speak with my employer’s lawyers to make sure that I have the exact coverage that is needed. In short, my experience with Tim has been excellent.

Psychiatrist in CaliforniaDavid immediately sent me the quotes from different insurance companies and advised me about which one would be appropriate for my type of practice. He was very responsive, always returning my phone calls on time. He also had great advice and suggestions how to proceed. I recommend him highly without any reservations.

Historic Medical Malpractice Insurance Rates in California for Physicians.

FAQs About Malpractice Insurance in California

How has the MICRA law changed recently?

As of 2023, California began gradually increasing caps on non-economic damages in malpractice cases, raising potential liability for physicians. Coverage should now account for these higher limits.

Do all California doctors need tail coverage?

If you have a claims-made policy and plan to switch jobs, retire, or leave the state, tail coverage is strongly recommended.

Can I get coverage for part-time or telemedicine work?

Yes. We help physicians with flexible practice models—including those seeing patients virtually—get policies tailored to their real risk.

How long does it take to get coverage?

In many cases, Cunningham Group can get you multiple quotes within 24–48 hours, depending on your specialty and application details.

Get a Quote from All Major California Carriers

We work with every top-rated malpractice insurance provider in California, including:

- The Doctors Company

- Medical Protective

- NORCAL Group

- Coverys

- Aspen / ProAssurance

Let us help you compare your options, find the best pricing, and avoid gaps in protection. Quotes are fast, free, and customized to your needs.