Start Your Custom Quote Process™

Malpractice Insurance for Texas Physicians

Compare Quotes from Every Major Medical Malpractice Carrier in Texas

Our partners

Table of Contents

- Medical Liability Claims Trends for Texas Healthcare Providers

- Where Texas Physicians Practice, and Why It Impacts Coverage

- Do You Need Malpractice Insurance in Texas?

- Client Testimonials

- How Much Does Malpractice Insurance Cost in Texas?

- Medical malpractice mature, base rates with no credits or discounts in Texas:

- How to Get the Right Coverage at the Best Price

- Historic Medical Malpractice Insurance Rates in Texas for Physicians.

- FAQs About Malpractice Insurance in Texas

- Get a Quote from All Major Texas Carriers

- Helpful Resources for Texas Physicians

What Texas Medical Professionals Need to Know

Medical malpractice insurance is essential for physicians practicing in Texas. Whether you’re based in a high-volume urban area like Houston or Dallas, or serving a smaller community, having the right coverage protects your career, reputation, and financial stability.

Texas has a unique legal and insurance environment that affects malpractice premiums, coverage requirements, and claim patterns. With access to every major carrier in the state, Cunningham Group helps doctors shop smarter—getting the right policy at the best price.

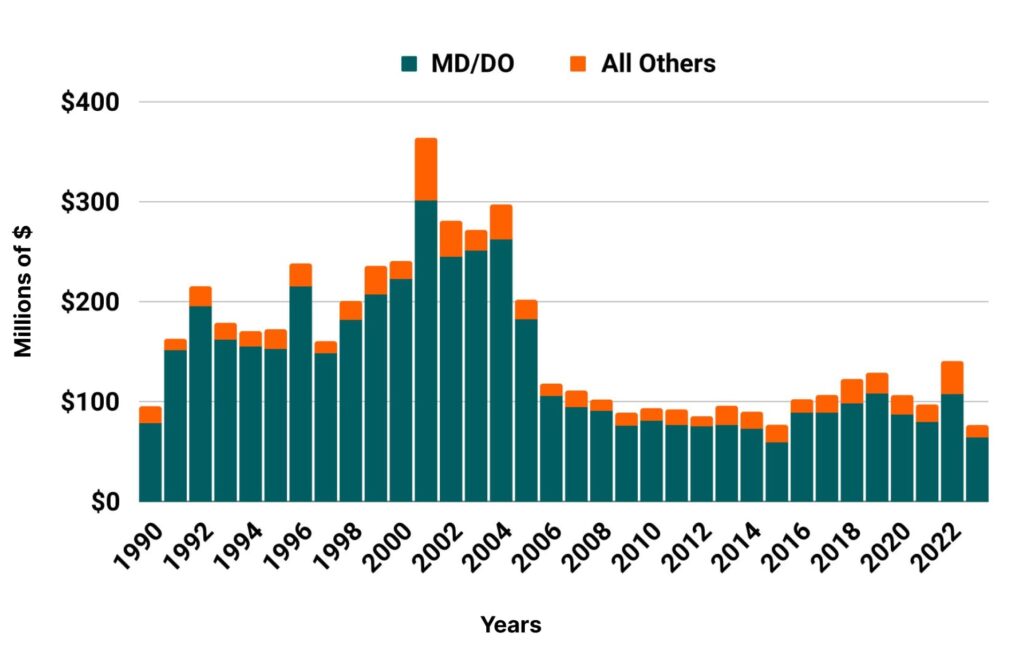

Medical Liability Claims Trends for Texas Healthcare Providers

Texas NPDB from 1990 to 2023

Where Texas Physicians Practice, and Why It Impacts Coverage

Texas is home to some of the largest and most diverse healthcare hubs in the country. However, your practice location plays a major role in determining your premium.

- Urban areas like Dallas, Houston, and Austin typically have more competitive markets and lower premiums.

- Regions like McAllen or the Rio Grande Valley often see much higher rates due to claims history and perceived legal risk.

Local market dynamics and historical payout trends can significantly affect your rates. That’s why it’s important to work with a broker who understands both your specialty and your zip code.

Do You Need Malpractice Insurance in Texas?

Technically, Texas doesn’t require physicians to carry malpractice insurance by law. However:

- Most hospitals and medical groups do. You’ll likely need active coverage to gain admitting privileges or employment.

- Tail coverage is essential if you’re leaving a claims-made policy, retiring, or changing jobs to ensure continued protection against late-filed claims.

Most providers choose to carry coverage regardless of legal requirements. The financial and reputational risks are simply too high to go without.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Internist in TexasTim, I thank you for all the help in getting my malpractice insurance. Your patience is to be complimented, given my lack of aptitude with modern technology.

Medical Director in TexasTim Arnieri has been assisting me with both medical malpractice insurance and medical director malpractice insurance and has done a superb job. I’ve had a first rate experience with this group.

How Much Does Malpractice Insurance Cost in Texas?

Malpractice insurance costs in Texas can vary significantly depending on your specialty, practice location, and claims history.

Rates tend to be higher in certain regions of Texas, particularly areas with a history of large claims or higher legal risk. For example, a physician practicing in a high-risk county may pay substantially more than one located in a more stable legal environment.

Thanks to our extensive network of carrier partners, we frequently help reduce your final premium by 25–40%. By shopping your coverage across more insurers than anyone else in Texas, we ensure you receive the most competitive rate for your specialty.

Want to see what your policy might cost?

Medical malpractice mature, base rates with no credits or discounts in Texas:

Texas

- Internal Medicine Average Rate $4,222

- General Surgeon Average Rate $14,988

- OB/gyn – Average Rate $19,632

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Cunningham Group can typically get our clients a 30-50% reduction from these rates.

How to Get the Right Coverage at the Best Price

Malpractice insurance isn’t one-size-fits-all. The best way to secure the right policy is by working with a broker who can assess:

- The type of policy that fits your situation (claims-made vs. occurrence)

- Your coverage limits and tail needs

- Your hospital or employer’s credentialing requirements

- Available discounts for things like risk management training or clean claims history

The agent’s fee is already built into your premium—whether you go direct or use a broker. But going direct means you might miss better pricing or coverage. We help you see the full market and advocate for your best outcome.

Key Facts About Texas Malpractice Laws

- Damage Caps: Texas has a $250,000 cap on non-economic damages (pain/suffering) for individual providers, and $500,000 per case for hospitals or facilities.

- Common Limits: Most policies in Texas offer limits of $200,000 per claim / $600,000 annual aggregate.

Historic Medical Malpractice Insurance Rates in Texas for Physicians.

FAQs About Malpractice Insurance in Texas

Is malpractice insurance required to practice in Texas?

No, but most hospitals and employers will require it—and going without can expose you to significant legal and financial risk.

How does tail coverage work in Texas?

If you’re on a claims-made policy and leave your job or retire, you’ll need tail coverage to protect against future claims tied to past care.

Can I lower my limits to reduce my premium?

It’s possible, but not recommended. Lower limits can leave you exposed in a large verdict. We focus on helping you save by shopping smarter—not skimping on protection.

Do I pay extra to work with Cunningham Group?

No. Agent commissions are built into your premium whether you go direct or use us. But we shop across all major carriers, so you get the best deal possible.

Get a Quote from All Major Texas Carriers

We work with:

- Texas Medical Liability Trust (TMLT)

- ProAssurance

- Medical Protective

- ISMIE

- And more

Let us help you secure the right policy with the right carrier.